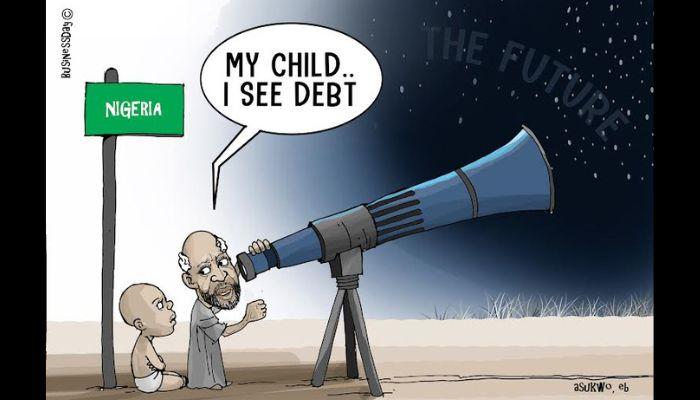

Nigeria’s whole public debt has risen by N27.72 trillion to N149.39 trillion in a single 12 months, largely attributable to a weak naira that’s continued to balloon the nation’s exterior obligations.

Knowledge from the Debt Administration Workplace (DMO) present that Africa’s most populous nation’s debt elevated by 22.8 % year-on-year as of March 31, 2025 in comparison with N121.67 trillion recorded within the prior interval final 12 months.

On a quarterly foundation, the nation’s debt surged by N4.72 trillion or 3.3 % from N144.67 trillion as of December 31, 2024, signaling each recent borrowings and the influence of a weakening forex on international debt obligations.

The rising public debt inventory continues to boost considerations in regards to the nation’s debt sustainability, notably in view of underperforming revenues.

Learn additionally: Debt pressure mounts as FG misses revenue target by 31%

In a bid to scale back borrowings and enhance the nation’s income base, President Bola Tinubu not too long ago signed 4 landmark tax reform payments which are anticipated to unlock funding and improve the nation’s tax-to-GDP ratio.

The federal authorities can also be more and more partaking in concessionaire financing and public personal partnerships to chop its publicity to exterior debt. However pressures nonetheless persist.

Nigeria’s exterior debt, although rose marginally in greenback phrases ($42.12 billion to $45.98 y-on-y) soared by 26 % in naira phrases as devaluation takes a toll on the nation’s international debt.

The debt obligation jumped to N70.63 trillion from N56.02 trillion in the identical interval in 2024, regardless that it noticed a modest development on a quarterly account by N344 billion.

Learn additionally: Nigeria’s tax reforms set to unlock billions in investment, revenue

Nigeria continues to face a debt disaster attributable to its weakened forex that’s made mortgage repayments considerably a burden. The naira shed greater than 41 % of its worth in 2024.

Whereas the forex has witnessed some latest stability, it’s nonetheless weak, piling strain on servicing the nation’s debt inventory.

Home debt additionally maintained an upward trajectory, rising to N78.76 trillion or $51.26 billion on the finish of March 2025.

In keeping with the DMO, the composition of the overall public debt confirmed a near-even break up, with home debt accounting for 52.7 % and exterior debt making up 47.3 %.

Learn additionally: Nigeria’s debt hits record N145trn on rising borrowings

This represents a slight shift from the construction recorded in March 2024, when home debt had the next share of 54 % whereas exterior debt stood at 46 %.

A report by CardinalStone earlier within the 12 months had predicted that Nigeria’s debt might balloon to N187.79 trillion by the tip of this 12 months.

The analysts mentioned the surge can be fueled by the issuance of a dollar-denominated home bond ($900.00 billion), common borrowings by Nigeria Treasury Payments (NTBs) and bonds, and the nation’s latest return to the Eurobond market to boost $2.20 billion.

It added that the nation has Eurobond maturities averaging $1.33 billion yearly over the subsequent decade. Together with coupon funds, whole annual debt servicing prices might common $2.24 billion.

Though the present public debt-to-GDP ratio is barely under the IMF’s 60 % benchmark for rising market international locations, the nation’s weak income profile and FX volatility dangers might additional escalate debt ranges, straining the already strained economic system.