156

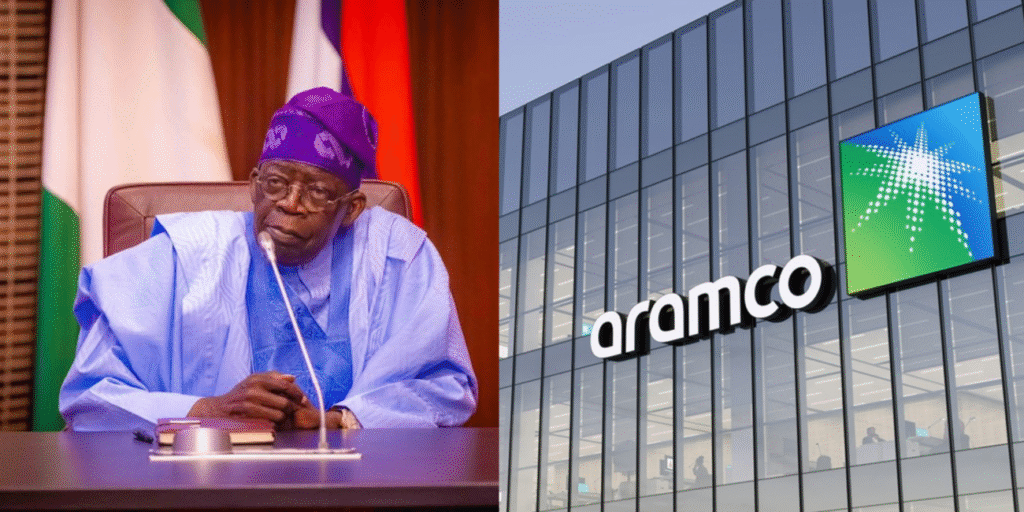

Nigeria and Saudi Arabia’s oil large, Aramco, are going through challenges in finalising a landmark $5 billion oil-backed mortgage, as a latest downturn in crude costs raises issues amongst banks anticipated to assist the deal, in line with 4 sources cited by Reuters.

The power, which might be Nigeria’s largest oil-backed mortgage to this point and Saudi Arabia’s most vital monetary engagement within the nation, is now liable to being downsized as a result of decline in oil costs, sources revealed.

President Bola Tinubu initially proposed the mortgage throughout his assembly with Saudi Crown Prince Mohammed bin Salman on the Saudi-African Summit in Riyadh final November. Whereas discussions have continued, particulars of the negotiations had not been publicly disclosed till now.

Oil Costs Complicate Mortgage Negotiations

The sluggish progress displays the broader impression of falling oil costs, largely influenced by OPEC+ coverage shifts aimed toward regaining market share quite than proscribing provide.

Brent crude has dropped practically 20%, slipping from over $82 per barrel in January to round $65 per barrel.

This decline could require Nigeria to commit extra oil barrels to safe the mortgage, however long-standing underinvestment within the sector has made assembly manufacturing targets more and more tough.

Final month, Tinubu sought approval for $21.5 billion in overseas borrowing to strengthen Nigeria’s finances, with the proposed $5 billion oil-backed mortgage from Aramco positioned as a key element of that monetary technique, in line with sources.

Bankers Voice Issues

Banks in talks to co-finance a part of the mortgage with Aramco have raised issues over oil supply delays, slowing negotiations, sources stated. The discussions contain Gulf lenders and at the least one African financial institution, although Reuters couldn’t affirm their identities

“It’s onerous to search out anybody to underwrite it,” one supply stated, citing issues over the provision of the cargoes.

Nigeria has a protracted historical past of securing and repaying oil-backed loans, which it sometimes makes use of to bolster finances assist, shore up overseas reserves, or overhaul state-owned refineries.

Sources say that the proposed $5 billion mortgage from Aramco can be backed by at the least 100,000 barrels of oil per day. Nonetheless, this new mortgage would nearly double the full oil-backed loans—roughly $7 billion—that Nigeria has taken previously 5 years.

Presently, at the least 300,000 barrels per day are used to repay different oil-backed loans from the Nigerian Nationwide Petroleum Company (NNPC), though one in every of these services is anticipated to be paid off this month. Whereas the amount of crude allotted to mortgage repayments is fastened, a decline in oil costs means it takes longer to settle these money owed. Decrease costs additionally pressure the NNPC to allocate extra crude to joint-venture companions, which vary from worldwide majors like Shell to home producers akin to Oando or Seplat, to cowl its share of operational prices.

“It’s important to both discover extra oil, or discover a method to renegotiate these offers,” one other supply stated.

Oando to Deal with Offtake

Sources point out that Nigerian buying and selling agency Oando is about to supervise the offtake of bodily cargoes. In the meantime, the Nigerian Nationwide Petroleum Company (NNPC) is working to ramp up oil manufacturing, as President Bola Tinubu has issued an govt order aimed toward decreasing prices and maximizing income per barrel.

Nigeria, Africa’s largest oil exporter, had primarily based its finances on a projected oil value of $75 per barrel, with an estimated manufacturing degree of two million barrels per day (bpd). Nonetheless, in April, precise output fell brief, reaching slightly below 1.5 million bpd, in line with OPEC’s Might market report.

Saudi Aramco declined to remark, whereas Nigeria’s state-owned oil firm, NNPC, additionally remained silent on the matter. Equally, each the finance and petroleum ministries didn’t problem any feedback, and Oando didn’t reply to questions from Reuters.

Throughout President Muhammadu Buhari’s administration, Nigeria secured a number of oil-backed loans to assist its economic system, stabilise overseas alternate, and finance authorities tasks.

Nigeria did take oil-backed loans, most notably from establishments like Afreximbank and worldwide lenders. One vital deal was the $1.5 billion mortgage from Afreximbank in 2021, which was backed by crude oil and aimed toward stabilising Nigeria’s economic system and overseas alternate reserves.

One other main oil-backed mortgage was the $3 billion crude-for-cash settlement with worldwide merchants in 2020, which allowed Nigeria to alternate crude oil for fast money stream to fund authorities bills.

Additionally, $3.3 billion mortgage from the African Export-Import Financial institution (Afreximbank), was obtained in August 2023.

This mortgage was backed by crude oil revenues and aimed toward stabilising market liquidity following the removing of gasoline subsidies and the unification of the overseas alternate market.

Stories point out that over the previous 5 years, Nigeria took roughly $7 billion in oil-backed loans, with at the least 300,000 barrels per day (bpd) allotted for compensation.

The nation additionally engaged in crude-for-refined-products swap offers, the place crude oil was exchanged for refined petroleum merchandise attributable to home refining challenges. These agreements contributed to Nigeria’s monetary obligations and impacted its capability to generate income from crude gross sales.

Publish Views: 307