…Prolonged bill phrases are crushing SMEs and stifling financial progress

…It’s time for presidency and enterprise associations to behave

In boardrooms and procurement departments internationally, a dangerous and exploitative apply continues to achieve floor—providing 60- to 90-day cost phrases to small and medium enterprises (SMEs) for providers rendered and items delivered. What could look like an ordinary enterprise process is, in reality, a gradual, systemic strangulation of small companies.

For a lot of SMEs, these cost phrases translate into deferred salaries, mounting money owed, damaged provide chains, and eventual closure. But, this has been normalized, even institutionalized, by among the world’s most worthwhile companies.

Let’s be clear: whether it is unlawful and unethical to owe workers for 3 months, then it’s equally unconscionable to delay cost to contractors and distributors—a lot of whom additionally make use of employees, pay taxes, and help total communities.

Unfair Phrases, Actual Penalties

The logic behind prolonged cost phrases is easy—protect the money move of the bigger firm by transferring liquidity stress to the smaller social gathering. However the penalties are devastating.

Payrolls are missed, resulting in employees attrition and hardship.

Tax and pension obligations go unmet, attracting penalties.

SMEs grow to be riskier debtors, shedding entry to important credit score traces.

The ripple impact spreads, destabilizing total worth chains.

This isn’t simply unhealthy apply; it’s unhealthy economics. In most growing nations, SMEs contribute as much as 80% of employment and a big share of GDP. To throttle this sector is to undermine the inspiration of the financial system itself.

A Type of Financial Exploitation

The apply bears uncomfortable resemblance to a contemporary type of monetary servitude. The SME delivers worth now however should wait 90 days—typically extra—for cost. The bigger firm, in the meantime, data the profit instantly, however defers the fee. That is an imbalance of energy dressed up as contractual settlement.

It’s disingenuous for big companies to tout their company duty credentials, whereas utilizing cost delays as a money administration instrument. An organization that prides itself on ESG compliance shouldn’t perpetuate a tradition of “pay when handy” on the expense of its smallest companions.

A Name for Pressing Reform

Governments, regulatory businesses, and enterprise chambers should rise to this problem. It’s time to transfer from advocacy to enforcement.

Coverage options ought to embrace:

Laws mandating a most 30-day cost window for SMEs.

Automated penalties and curiosity on delayed funds.

Public disclosure of cost efficiency by massive companies.

Empowerment of commerce associations to escalate non-compliance and advocate for members.

The UK’s Immediate Cost Code and related initiatives in Europe are steps in the precise course, however enforcement has been weak, and compliance largely voluntary. In Africa, Asia, and Latin America, the scenario is worse, with SMEs routinely ready over 120 days for cost.

Why This Issues Now

In a post-pandemic financial system marked by inflation, foreign money volatility, and rising enter prices, SMEs can not afford to bankroll the operations of bigger entities. Well timed cost is just not a favour—it’s a contractual and moral obligation.

If governments really help small enterprise, and if large companies are honest of their social duty pledges, then truthful cost practices should grow to be a non-negotiable commonplace.

Conclusion: Pay SMEs Promptly—Or Pay the Value Later

The continued abuse of cost phrases is a menace to innovation, jobs, and financial resilience. It’s a silent killer of small companies, hiding behind the forms of procurement techniques.

It’s time to confront this head-on. Delayed funds should not only a monetary challenge—they’re an ethical and financial disaster.

Let this be the turning level. Allow us to champion a brand new enterprise tradition the place contracts are honoured, obligations are met on time, and the lifeblood of enterprise—money move—is revered.

Something much less is exploitation.

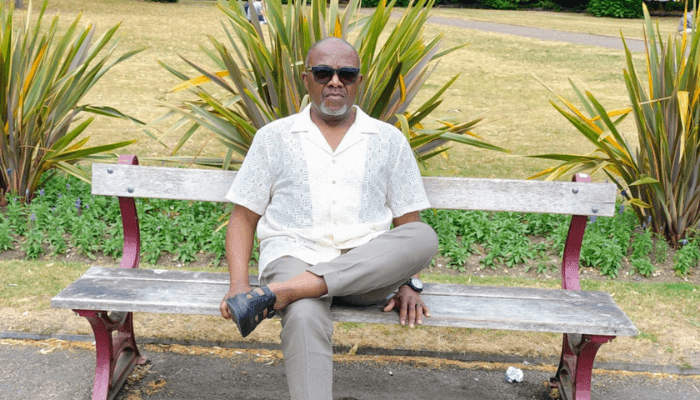

Dr Emmanuel Okoroafor is a enterprise govt and entrepreneur with over three many years of expertise in human capital administration, oil & fuel, and African commerce improvement. He’s the CEO of Hobark Consultants Administration Companies Ltd and founding father of MEPON Ltd.