Nigeria’s financial system has been projected for enlargement this 12 months, with actual GDP progress anticipated to rise to 4.4 p.c as reforms form progress, analysts disclosed.

The projected progress has been supported by varied famend analysts, the Central Financial institution of Nigeria, and respected funding homes, because the 2026 financial outlook is anticipated to replicate sustained features from ongoing reforms, stronger non-public sector funding, and improved macroeconomic stability.

President Bola Tinubu, in his New 12 months’s speech, stated the nation closed 2025 on a robust be aware. Regardless of the insurance policies to combat inflation, Nigeria has recorded a sturdy GDP progress every quarter, with annualised progress anticipated to exceed 4 p.c for the 12 months.

In line with CBN’s 2026 Macroeconomic Outlook for Nigeria, Nigeria’s financial system is projected to develop by 4.49 p.c in 2026 on the implementation of well-sequenced, constant fiscal and financial insurance policies.

Equally, Muda Yusuf, chief govt officer of CPPE, in his evaluate of the Nigerian financial system in 2025 and outlook for 2026, expressed cautious optimism for 2026, projecting GDP progress of between 4.0 and 4.5 p.c, supported by moderating inflation and stronger non-oil sector efficiency.

He stated the easing inflation may create room for gradual financial easing, stimulate non-public funding, and strengthen home demand.

Nonetheless, Yusuf warned that a number of dangers persist, together with insecurity, oil value and manufacturing volatility, excessive power and logistics prices, rising debt-service burdens, estimated at over N15 trillion within the 2026 appropriation, and potential pre-election fiscal pressures. Rising resistance to tax reforms and exterior geopolitical headwinds have been additionally recognized as draw back dangers.

Yusuf added that sustaining reform momentum and addressing safety and structural constraints can be vital to translating stability into inclusive progress.

Bismarck Rewane, an economist and managing director of Monetary Derivatives Firm (FDC), stated Nigeria’s GDP progress is forecast to rise to 4.1 p.c in 2026, pushed by increasing enterprise exercise, infrastructure enhancements, industrial-policy execution, stronger private-sector credit score, higher commerce flows, and better home worth addition.

Learn additionally: Nigeria’s tax-to-GDP ratio seen rising in 2026 as reforms kick in

He notes that consumption, which has been closely eroded by inflation, is anticipated to recuperate steadily, whereas funding spending might be supported by sturdy government-bond issuance and public infrastructure enlargement.

Rewane identifies six industries he believes will form Nigeria’s financial route in 2026, with agriculture and agro-processing main with projected earnings of N104.6 trillion.

That is adopted by actual property and development with N72.41 trillion; telecommunications with N41.07 trillion; manufacturing with N38.25 trillion; the inventive financial system with N7.23 trillion; and know-how and fintech with N2.97 trillion.

He famous that every of those sectors is present process its personal structural transformation pushed by demographic stress, digital enlargement, urbanisation, regional commerce integration, and the broader macroeconomic adjustment.

Baboye Olaolu, lead economist and stuck earnings strategist at CardinalStone, throughout an interview on Channels TV, stated Nigeria’s outlook from 2025 into 2026 resembles 2019, a interval marked by relative macroeconomic stability.

Olaolu tasks nominal GDP of about N507 trillion (roughly $362 billion) in 2026, supported by moderating inflation, improved FX stability, and recovering enterprise profitability. He expects inflation to fall under the long-run common of 14 p.c, creating room for financial easing.

He added that improved FX liquidity, rising overseas investor confidence, and rising non-oil exports, significantly fuel and refined merchandise, will assist maintain progress and assist GDP enlargement.

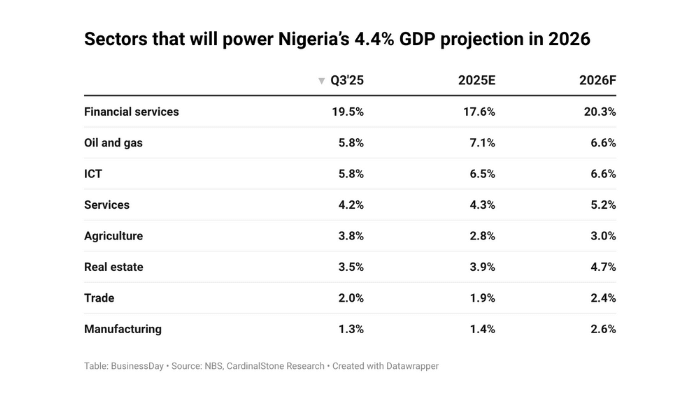

In line with the 2026 Macroeconomic Outlook by CardinalStone Analysis, Nigeria’s actual GDP is anticipated to rise to 4.4 p.c in 2026, supported by a broad-based restoration throughout oil and fuel, providers, development, agriculture, and the digital financial system.

The report stated the projected acceleration marks a transparent break from the previous decade, when actual GDP progress averaged round 2 p.c, and displays the influence of macroeconomic reforms, bettering exterior balances, and easing inflationary pressures.

“After practically a decade of actual GDP progress averaging about 2.0 p.c, progress is prone to discover a new stage of 4.4 p.c in 2026 and over 4.5 p.c–5.0 p.c within the medium time period,” CardinalStone Analysis famous

Learn additionally: GDP growth dropped by 0.25% in Q3 2025, Cardoso tells Senate

Listed here are the sectors that can energy Nigeria’s projected progress

Companies Sector

The providers sector is projected to stay Nigeria’s largest progress engine in 2026, reflecting the financial system’s service-driven construction.

In line with CardinalStone, home commerce, the most important contributor to providers, is anticipated to report 2.4 p.c progress, marking its strongest efficiency since earlier than the COVID-19 pandemic.

“Commerce margins are prone to be firmer, as recovering native consumption, normalisation of power and logistics prices are optimistic for commerce volumes and stock cycles,” the report said.

Actual property, which accounts for practically 1 / 4 of the providers sector, is forecast to develop by 4.7 p.c in 2026, up from 3.9 p.c in 2025, supported by urbanisation and infrastructure spending.

The report famous that the Renewed Hope Mission and elevated state-level investments in roads and airports are anticipated to carry sectoral output.

In ICT, progress is projected at 6.6 p.c, pushed by greater capital expenditure by cellular community operators (MNOs) following current tariff will increase, alongside broader 4G and 5G rollouts.

CardinalStone highlighted that broader community protection and development in applied sciences, particularly in relation to important digital ecosystem parts like knowledge centres, would assist progress, though it warned that the NIN-SIM hyperlink stays a serious draw back to our outlook.

The strongest enlargement inside providers is anticipated in monetary providers, with progress projected at 20.3 p.c in 2026, up from 17.6 p.c in 2025.

“That is anticipated to be pushed by greater banking charges, stronger credit score creation following a discount within the financial coverage fee, and rising digital banking charges as a consequence of aggressive digital investments by banks,” the report disclosed.

Oil and Fuel

Nigeria’s oil and fuel sector is anticipated to develop by 6.6 p.c in 2026, barely decrease than the 7.1 p.c anticipated in 2025, as base results fade.

Nonetheless, CardinalStone tasks common oil manufacturing to rise to 1.75 million barrels per day, in contrast with 1.67 million barrels per day in 2025.

The development is linked to declining crude losses, which the report stated at the moment are at their lowest stage since 2009, alongside annual licensing rounds targeted on underdeveloped and deepwater fields.

Funding momentum stays sturdy, supported by govt orders issued in 2024 and 2025. In line with the report, these measures culminated in $16.0 billion in new funding commitments during the last two years.

Fuel growth can be gaining prominence. CardinalStone famous a robust business push towards the event of pure fuel manufacturing, discount of fuel flaring, and elevated fuel commercialisation, with firms akin to Seplat increasing into LPG and CNG tasks to serve industrial and home customers.

Agriculture

The agricultural sector is projected to develop by 3.0 p.c in 2026, barely above the two.8 p.c progress recorded in 2025, supported by improved power availability and overseas change stability.

A key growth is the reconstitution of the Agricultural Credit score Assure Scheme Fund (ACGSF) board by the apex financial institution.

CardinalStone famous that whereas it’s unclear whether or not this can be a resumption of CBN’s discontinued growth funds, the scheme is designed to de-risk agricultural lending and will assist unlock incremental credit score to the sector.

The report highlighted that agriculture has obtained solely about 5.0 p.c of whole banking system credit score over the previous 5 years, underscoring the necessity for elevated financing to lift productiveness and output.

Manufacturing

Manufacturing progress is forecast to achieve 2.6 p.c in 2026, up from 1.4 p.c anticipated in 2025, as easing inflation, improved FX situations, and anticipated financial coverage easing assist output.

CardinalStone noticed that the sector has been gradual to reply to current reforms as a result of lagged influence of the federal government’s insurance policies and elevated rates of interest, with companies borrowing at near or above 30 p.c in 2025.

Nonetheless, the report expects a 300–400 foundation level reduce within the financial coverage fee to enhance credit score situations. Further assist is anticipated from improved refining capability, significantly because the Dangote Refinery plans to scale output from 650,000 barrels per day (bpd) to 700 bpd in 2026, with longer-term enlargement targets in view.