In a rustic as soon as outlined by oil, Nigeria’s financial system is present process a quiet transformation. The actual engine of development is not present in pipelines or refinery gates, however in fields, markets, and smartphones.

A current change in how the financial system is measured has introduced this shift into sharp focus. Often known as GDP rebasing, the train updates the best way the nation calculates its financial output, utilizing brisker knowledge to mirror how Nigerians truly earn and spend. And the outcomes inform a distinct story.

The long-held picture of an oil-fuelled, industry-led financial system is fading. Agriculture and companies have grown in prominence, whereas {industry}, particularly manufacturing, has shrunk.

The brand new breakdown

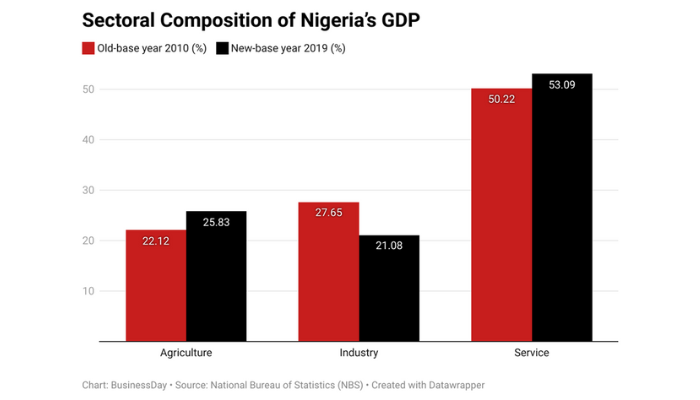

Primarily based on the outdated calculation technique utilizing 2010 costs, Nigeria’s 2019 financial system was estimated to comprise 22.1 % agriculture, 27.7 % {industry}, and 50.2 % companies. The revised knowledge tells a distinct story: agriculture now accounts for 25.8 %, {industry} has dropped to 21.1 %, and companies have grown to 53.1 %.

Learn additionally: Nigeria below regional peers as manufacturing accounts for just 12.7% of GDP – Minister

The numbers could appear technical, however the implications are deeply private. Agriculture’s rise displays what rural households already expertise: farming is central to survival, not a final resort.

Nonetheless, not everyone seems to be satisfied this displays actual progress. “In my view, whereas the rebasing is well timed, productiveness has not elevated in the actual sense. We’re nonetheless working under potential,” stated Abdulbasit Shuaib, an economist with a multinational firm. His concern is echoed in elements of the nation the place day by day realities nonetheless don’t match the story that rebased knowledge suggests.

The sharp drop in {industry} alerts the deepening struggles of factories going through energy cuts, excessive enter prices, and unclear regulation. Providers, in the meantime, have emerged as the actual development story, from logistics and cell banking to barbershops and social media advertising.

What’s altering on the bottom?

For the typical Nigerian, this shift means the financial system is lastly catching up with lived expertise. Most individuals don’t work in oil rigs or factories. They promote, ship, sew, code, plant, or drive. These actions, as soon as sidelined in coverage conversations, at the moment are the nation’s financial core.

The rebasing makes one factor clear: Nigeria’s financial system isn’t just about exports or income from crude oil. It’s about individuals making issues work in a troublesome surroundings, typically informally, typically with out help.

This could form how governments plan. Investing in rural roads, irrigation, cell connectivity, and concrete transport would go additional than one other tax break for oil multinationals. If agriculture and companies are the place individuals discover work and earnings, then that’s the place help ought to go.

“Reversing this development will take greater than rhetoric. It is going to require coordinated reform: secure energy, inexpensive finance, focused help for native inputs, and a tax system that doesn’t punish productiveness.”

The ache within the manufacturing facility belt

Trade’s decline is greater than only a statistical dip. It’s an indication that native manufacturing, as soon as the nice hope of financial diversification, is in misery. Many companies are scaling again or shutting down on account of unreliable electrical energy, a number of taxes, costly imports, and crumbling infrastructure.

Learn additionally: Tourism and hospitality: Unlocking Africa’s hidden engine of GDP growth

It is a concern as a result of industrial jobs are typically extra secure, formal, and export-orientated. Manufacturing additionally helps wider worth chains from suppliers to transporters. Letting it wither may imply giving up on balanced development and long-term competitiveness.

Reversing this development will take greater than rhetoric. It is going to require coordinated reform: secure energy, inexpensive finance, focused help for native inputs, and a tax system that doesn’t punish productiveness.

The rise of the companies sector

Providers now drive greater than half of the financial system. A few of that is in banking, telecoms, and finance. However a variety of it’s casual: ride-hailing, on-line retail, cleansing companies, and logistics.

This development shouldn’t be with out threat. Casual jobs typically lack safety, advantages, or constant pay. However additionally they present innovation and resilience. With restricted sources, Nigerians are constructing options and serving rising demand.

To make this sustainable, the federal government should catch up. It must develop digital entry, provide vocational coaching, enhance broadband protection, and enact legal guidelines to guard each companies and shoppers.

Not simply an accounting train

GDP rebasing isn’t just about new numbers. It’s a mirror. And what it exhibits is that Nigeria’s financial system is altering quietly, quickly, and from the underside up.

Whereas it provides buyers and policymakers a clearer image of the place development is going on, it doesn’t resolve deeper financial challenges.

“Rebasing is nice as a result of it exhibits the place the financial system is performing and the place buyers can direct their funds,” stated Marcel Okeke, former chief economist at Zenith Financial institution. “However for actual influence, points like inflation, insecurity, and poor infrastructure should even be tackled. These are the components that really drive financial confidence.”

But some analysts warning that these modifications, although helpful on paper, might obscure deeper weaknesses. “This financial system is much under its potential, as the info recommend. $250 billion is kind of abysmal. In naira phrases there may be development as effectively. You see that trade price factor; comparative evaluation on a world scale will proceed to place us on the finish of the desk,” stated Oluwatobi Abisoye, a monetary and company report analyst.

Learn additionally: NBS to release Nigeria’s rebased GDP figure this month

Oil nonetheless issues. Nevertheless it not defines the financial system or the long run. Nigeria’s actual power now lies in its farmers, its tech entrepreneurs, its merchants, and its staff. Recognising and investing on this actuality could be the distinction between fragile restoration and lasting development.

To maneuver ahead, Nigeria should cease chasing legacy sectors and begin backing the actual financial system: its individuals, their concepts, and the sectors the place their labour truly lies.

Oluwatobi Ojabello, senior financial analyst at BusinessDay, holds a BSc and an MSc in Economics in addition to a PhD (in view) in Economics (Covenant, Ota).