…applauds NGX N100trn milestone, expenses Nigerians to speculate extra

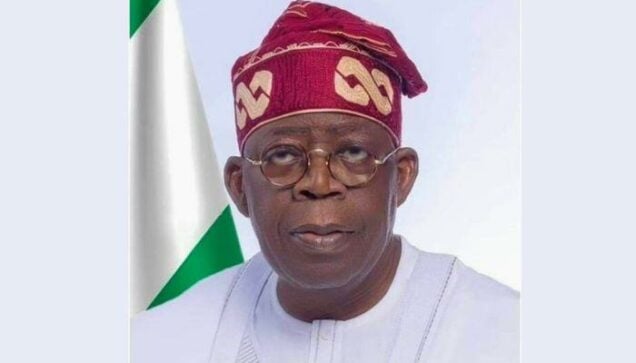

President Bola Tinubu, on Thursday, mentioned Nigeria’s present account steadiness was projected to rise to $18.81 billion in 2026, up from $16.94 billion in 2025, on the again of the continued financial reforms.

The President acknowledged this whereas applauding company Nigeria, residents, and different stakeholders within the Nigerian capital marketplace for surpassing the N100 trillion milestone on the Nigerian Trade (NGX).

Bayo Onanuga, Particular Adviser to the President on Data and Technique, mentioned the President described this “report achievement” as an inspiration for the investing public working within the cash and capital markets.

The President famous that the nation was not simply celebrating the superlative inventory market efficiency in isolation, however “we’re additionally celebrating the microeconomic results of our reforms.

“After the preliminary headwinds that adopted our reforms, we’re lastly seeing a bend within the inflation curve. Essential financial tightening and the removing of distortionary ‘Methods and Means’ financing have restored stability to the Naira.”

The President additionally famous that investments within the agriculture sector had contributed to a constant decline in inflation over the previous eight months.

Learn additionally: Tinubu lauds NGX’s N100trn market cap milestone, urges Nigerians to invest more locally

“From a 24-month excessive of 34.8% in December 2024, inflation decelerated to 14.45% as of November 2025, with projections indicating it should attain 12% in 2026”, he famous.

President Tinubu additionally hinted that “inflation is prone to fall under 10% earlier than the top of this 12 months, resulting in improved dwelling requirements and accelerated GDP progress.”

Tinubu assured that “12 months 2026 guarantees to be an epochal 12 months for delivering prosperity to all Nigerians.

He mentioned, “Additionally noteworthy is the standing of our nation’s present account, a sound measure of our general financial well being. In 2024, Nigeria posted a surplus of $16 billion. In keeping with the Central Financial institution of Nigeria (CBN), our present account steadiness is projected to rise to $18.81 billion in 2026, up from $16.94 billion in 2025.

“Underneath our administration, Nigeria is exporting extra and importing much less of what we will produce domestically. Non-oil exports surged by 48% by the third quarter of 2025, totalling N9.2 trillion. Exports to Africa alone rose by 97% to N4.9 trillion. Manufacturing exports elevated by 67% year-on-year within the second quarter of 2025, suggesting a robust near the 12 months.

“Nigeria’s international reserves have crossed the $45 billion mark, giving the Central Financial institution the firepower to take care of stability. The Naira has stabilised, transferring away from the volatility that when fuelled hypothesis. The Central Financial institution of Nigeria, in its newest outlook, tasks international reserves will cross the $50 billion threshold within the first quarter of 2026.”

He subsequently, urged Nigerians to deepen their investments within the native financial system, assuring that 2026 will yield even better returns as his administration’s financial reforms proceed to ship stronger outcomes.

“With the Nigerian Trade (NGX) crossing the historic N100 trillion market capitalisation mark, the nation is witnessing the beginning of a brand new financial actuality and rejuvenation.

“In 2025, whereas lots of the world’s markets struggled with stagnation or tepid restoration, the NGX All-Share Index was on the ascent. It closed 2025 with a 51.19% return, greater than the 37.65% recorded in 2024”, he added.

President Tinubu famous that the efficiency ranks among the many highest on the earth, including that “12 months-to-date returns have considerably outpaced the S&P 500, the FTSE 100, and even a lot of our emerging-market friends within the BRICS+ group.

“Nigeria is not a frontier market to be ignored—it’s now a compelling vacation spot the place worth is being found. Because the inventory market displays your entire financial system, its stellar efficiency is a big indicator of the nation’s financial well being and the arrogance buyers have in our financial system”, he famous.

Talking extra on the NGX, the President mentioned the nation had witnessed exceptional performances from listed firms throughout all sectors.

“From blue-chip industrial giants which have localised their provide chains, to a banking sector that has demonstrated resilience and technological innovation, Nigerian firms are proving that the nation can ship sturdy returns on funding.

“And we’re simply getting began. The pipeline for brand new and upcoming listings appears to be like strong. Extra indigenous vitality corporations, tech unicorns, telecoms, and infrastructure-heavy entities are searching for to entry the general public market to fund their growth. As these corporations are listed, they may enhance market capitalisation and deepen democratic possession of the Nigerian financial system.

*We’re additionally seeing an growth of the rail networks, the completion of main arterial roads and the revitalisation of our ports. With the transformative Lagos-Clabar and Sokoto-Badgry superhighways, the nation’s infrastructure is rising.

“Our medicare services are enhancing, and medical tourism prices are declining. Our college students profit from the Nigeria Training Mortgage Fund (NELFUND), and universities are receiving elevated analysis grants. The N100 trillion market capitalisation is a sign to the world that the Nigerian financial system is strong and productive.

“As your chief, I pledge to proceed working unrelentingly to construct an egalitarian, clear, and high-growth financial system that might be additional catalysed by the historic tax and monetary reforms that got here into full implementation from January 1”, President Tinubu concluded.