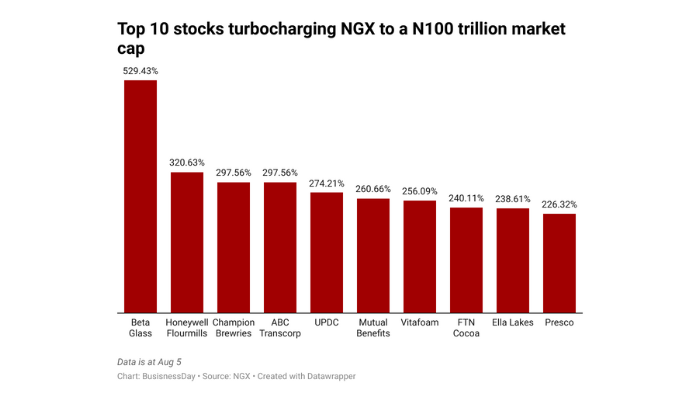

…Beta Glass, Honeywell, Champion Breweries lead the pack

…Analysts guess on banking, industrial, shopper shares

No fewer than 35 listed shares on the Nigerian Alternate Restricted (NGX) are fuelling the equities’ rally this 12 months, pushing the market capitalisation to just about N100 trillion.

The 35 shares have returned one hundred pc – 500 % to buyers in 2025, based on the NGX’s August 5 buying and selling knowledge.

Beta Glass Plc leads the pack, with a return of 529.43 % up to now this 12 months. Honeywell Flour Mills has been an buyers’ darling with 320.63 % acquire in 2025. Additionally, Champion Breweries has returned 290.81 %, with Nascon rewarding buyers with 217.38 % acquire.

Vitafoam (+256.09 %), Ellah Lakes (+238.61 %), and FTN Cocoa (+240.11percent) have additionally proven spectacular returns this 12 months.

Different shares which have risen remarkably this 12 months are: Okomu Oil Palm (+136.49 %), Presco (+226.32 %), NGX Group (+156.88 %), SCOA (+142.72 %), UACN (+217.97 %), Custodian (+128.95 %), Mutual Advantages (+260.66 %), NEM (+146.58 %), and UPDC (+274.21percent).

Learn additionally: NGX is on track for its most active year ever

Whereas Lafarge Africa is up this 12 months by 109.44 %, Wema Financial institution’s share value has elevated by 172.53 %.

Cadbury has jumped by 193.02 %, Worldwide Breweries (+149.55 %), Nigerian Breweries (+137.34 %), Nestle (+116 %), Northern Nigeria Flour Mills (+112.19 %), and Unilever (+142.79percent).

Additionally, Fidson has returned 183.23 % to buyers, with Neimeth rewarding them with a 236.24 % return.

Others are: CWG (+127.92 % return), Tripple Gee (+109.76 %), MTNN (+140 %), ABC Transcorp (+297.56 %), Academy Press (+198.33 %), Caverton (+190.95 %), NAHCO (+141.04 %), Redstar Categorical (+181.18 %), and Skyway Aviation Dealing with Firm (+169.21 %).

Buying and selling knowledge additionally present that the NGX Industrial Index has risen this 12 months by 54.64 %, NGX Banking Index (+48.11 %), NGX Insurance coverage Index (+37.37 %), whereas NGX Oil & Fuel Index is the one laggard with a detrimental return of 10.35 %.

Client items drive market

Decrease rates of interest and upcoming earnings/dividend expectations have saved the temper out there bullish.

The NGX Client Items Index has outperformed this 12 months with 79.59 % return as at August 5. It’s adopted by industrial, banking and insurance coverage shares whereas revenue taking in oil & fuel shares is making the sector lag behind others.

Analysts at Lagos-based Meristem see appreciable headroom for additional repricing, “notably inside the banking sector and the commercial and shopper items sectors, which proceed to profit from beneficial valuation multiples and sector-specific tailwinds.”

Learn additionally: NGX records best monthly performance since January 2024

Home buyers shine as foreigners increase bets

As at June 30, 2025, complete transactions on the nation’s bourse had elevated by 11.15 %, from N700.50 billion (about $441.64 million) in Might 2025 to N778.65 billion (about $509.02 million) in June 2025.

Between June 2024 and June 2025, complete transactions elevated considerably by 119.62 %.

In June 2025, the overall worth of transactions executed by home buyers outperformed transactions executed by international buyers by 64 %.

An additional evaluation of the overall transactions executed between June and Might 2025 reveals that complete home transactions elevated by 9.93 %, from N581.59 billion in Might 2025 to N639.34 billion in June 2025.

Additionally, complete international transactions elevated by 17.16 %, from N118.91 billion (about $74.97 million) to N139.31 billion (about $91.07 million) between Might 2025 and June 2025.

Institutional Traders outperformed retail Traders by 14 %. A comparability of home transactions between Might and June 2025 reveals that retail transactions decreased by 18.62 % from N337.46 billion in Might 2025 to N274.63 billion in June 2025.

The institutional composition of the home market elevated by 49.39 %, from N244.13 billion in Might 2025 to N364.71 billion in June 2025.

Whereas Vetiva analysts suggested buyers to train some stage of warning after the sharp run-up out there, CardinalStone analysis analysts stated its focus will possible shift to the banking sector “because the market awaits H1’25 earnings and interim dividend bulletins.”

The inventory market has maintained an upward trajectory in 2025, pushed by sustained investor urge for food for danger belongings and strategic positioning in basically undervalued tickers.

Learn additionally: NGX records +30.63% YtD return as stocks gain N1.8trn in one week

ASI and market cap

On the shut of buying and selling on Tuesday, the NGX All-Share Index (ASI) and the market capitalisation elevated to 144,796.37points and N91.608 trillion respectively.

“Wanting forward, market sentiment is anticipated to stay broadly optimistic as extra corporates launch their half-year outcomes and buyers place for potential interim dividends. That stated, some revenue taking could emerge, notably in shares which have posted robust latest rallies,” Coronation Analysis analysts stated of their August 4 be aware.

“As well as, developments within the mounted revenue house, similar to the end result of upcoming bond auctions, could affect short-term portfolio rebalancing selections.”