The Nigerian Trade (NGX) is poised to interrupt information in 2025, as strong investor exercise and renewed international curiosity put the native bourse on tempo for its most lively 12 months ever.

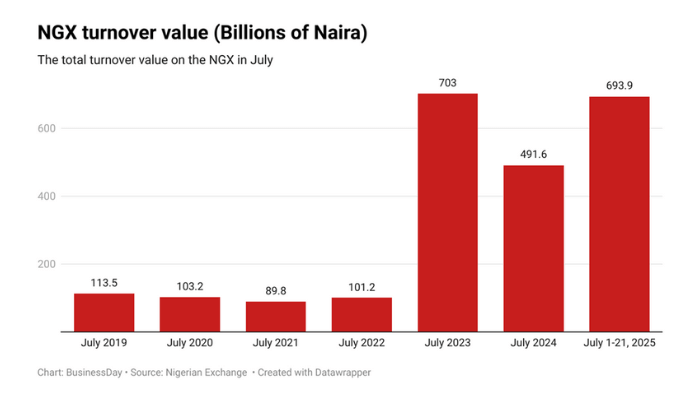

In simply the primary 14 buying and selling classes of July, the NGX recorded a turnover worth of N694 billion (roughly $454 million). This July determine alone already accounts for 15 p.c of complete market turnover recorded year-to-date, an early indication of one other landmark 12 months.

By July 21, the NGX had recorded a cumulative turnover worth of N4.5 trillion, representing 80.5 p.c of the N5.53 trillion turnover recorded in 2024, which was the very best annual determine in trendy historical past.

In 2008, when the monetary disaster hit, the market recorded a cumulative turnover of N4.758 trillion. Nevertheless, in USD phrases, the turnover was about $34 billion.

At this trajectory, 2025 is firmly heading in the right direction to surpass the 2024 milestone and etch itself into the historical past books.

Learn additionally: NGX six-month deals jump 61% on investor confidence

International capital is returning

One of many defining tales of 2025 has been the resurgence of international traders. Between January and Might, international transactions on the NGX totalled N996 billion ($638 million), the very best quantity of international trades since 2018. This development is being attributed to latest international change reforms and better readability across the Central Financial institution’s international change insurance policies, which have restored investor confidence.

In 2024, international transactions stood at N852 billion, then the very best stage since 2019. That determine represented a 15 p.c share of the whole market turnover, the biggest international participation seen since 2021. Nevertheless, by Might 2025, international participation had already soared to 29 p.c, practically double final 12 months’s stage.

Analysts count on this momentum to proceed, notably with Nigerian blue-chip shares gaining visibility with international institutional traders. GTCO Holdings’ itemizing on the London Inventory Trade earlier this 12 months is a key instance of how cross-border publicity is creating new channels for international capital inflows.

Retail traders are driving native momentum

Whereas international inflows are driving headlines, home participation has remained wholesome and balanced. Between January and Might 2025, home transactions totalled over N2.4 trillion, break up virtually evenly between retail traders (N1.197 trillion, or 49.5 p.c) and institutional traders (N1.22 trillion, or 50.5 p.c). The dynamic mirrors 2024’s numbers, the place retail traders accounted for 49.4 p.c of home exercise.

The sustained retail curiosity is essentially tied to the market’s staggering long-term returns. Because the begin of 2019, the NGX has delivered a cumulative return of 391 p.c, attracting a rising pool of on a regular basis traders and triggering deeper conversations round wealth creation and monetary inclusion.

Learn additionally: NGX poised for record-breaking year as investor confidence soars

Small Caps, Huge Positive aspects

Past the banking and manufacturing heavyweights, the true motion has been amongst decrease and mid-cap shares, a lot of which have posted astronomical positive factors in recent times.

Presco Plc has surged by over 2,000 p.c since 2019, with its market capitalisation leaping from N62 billion to N1.33 trillion. Transcorp Plc appreciated by 1,000 p.c between 2019 and its share reconstruction in October 2024. UAC Nigeria and Vitafoam have risen by 413 p.c and 1,900 p.c, respectively, in the identical interval.

These outsized returns are largely pushed by fundamentals, sturdy earnings development, resilient enterprise fashions, and constant dividend payouts, components that retail and institutional traders alike are more and more attuned to.

With over 5 months nonetheless left within the 12 months, the NGX’s efficiency to date positions it to shut 2025 as probably the most lively 12 months in its historical past. File turnovers, renewed international confidence, and broad-based retail enthusiasm are all converging to reshape the Nigerian capital market panorama.