The Luanda infrastructure financing summit holding in October is ready to mobilise a fund to remodel infrastructure throughout Africa.

A part of the funds is an estimated $1.3 trillion to implement the Continental Energy Methods Grasp Plan (CMP) and realise the African Single Electrical energy Market by 2040.

Organised by the African Union Improvement Company (AUDA-NEPAD) and the African Union Fee (AUC), in collaboration with the Authorities of Angola, the high-level gathering, is scheduled for October 28 to 31, 2025 in Angola’s capital- Luanda.

Africa’s financial system and labour market future may very well be dramatically reshaped through the summit which seeks to mobilise capital for infrastructure and power entry as world priorities, and can reinforce Africa’s management in proposing options tailor-made to its distinctive challenges and alternatives.

Presently, the continent faces an annual infrastructure financing hole exceeding $100 billion. The Programme for Infrastructure Improvement in Africa (PIDA) alone requires $16 billion yearly to ship cross-border initiatives that underpin Africa’s industrial and power ambitions by 2030.

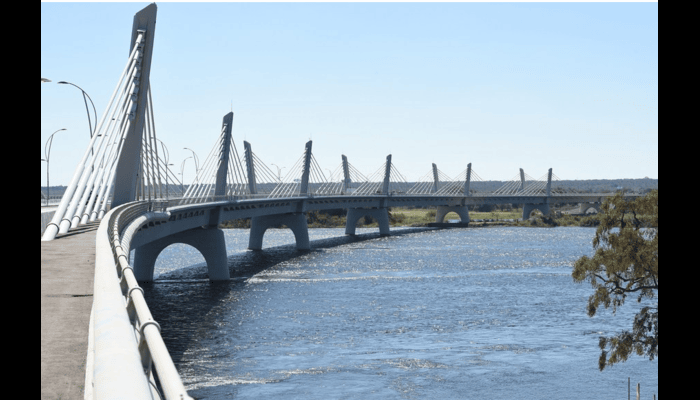

The high-level gathering, scheduled for October 28 to 31, 2025 in Angola’s capital- Luanda, goals to mobilise capital for transformative infrastructure initiatives comparable to roads, railways, ports, energy grids, and digital networks, that are important for commerce, industrialisation, regional integration, and job creation throughout the continent.

The summit builds on the momentum of earlier editions, notably the 2023 Dakar Summit, and aligns with the African Union’s Agenda 2063 and the PIDA.

Learn additionally:DMT, GLO sign MoU to improve telecom infrastructure in Delta State

Talking earlier this yr, João Lourenço, AU chairperson and Angolan president underscored the urgency of infrastructure funding, noting,“We should mobilise all obtainable monetary assets to realize our targets; from roads and railways to ports, energy strains, and digital networks.”

The Luanda summit will function curated deal rooms and funding pitch classes, enabling African governments and establishments to current infrastructure portfolios to world traders. Strategic corridors such because the Lobito Hall, LAPSSET, and the Dakar–Bamako–Djibouti route can be showcased as built-in fashions linking infrastructure with commerce and industrial growth.

A serious focus can be Africa’s power deficit, with over 600 million folks missing entry to electrical energy. By means of initiatives just like the African Single Electrical energy Market and PIDA Vitality Tasks, the summit will discover financing mechanisms to shut this hole, together with partnerships with philanthropic organisations and climate-aligned capital. The Nairobi Roadmap, adopted by AUDA-NEPAD and key monetary establishments, will function a guiding framework.

How Africa’s infrastructural growth can catalyse labour market progress

Infrastructure growth provides a strong catalyst for labour market progress throughout Africa, with wide-ranging advantages that reach past conventional employment sectors. One of the crucial rapid impacts is job creation. Massive-scale initiatives comparable to roads, railways, ports, and energy grids generate hundreds of thousands of employment alternatives in development, engineering, logistics, and upkeep. These roles not solely soak up present labour but in addition stimulate demand for brand new abilities and companies. Moreover, the growth of power and digital infrastructure opens up contemporary avenues in expertise, utilities, and entrepreneurship, making a extra diversified and resilient job market.

Past job creation, infrastructure funding drives abilities growth, significantly amongst younger folks. The complexity and scale of those initiatives require a talented workforce, prompting governments and personal sector actors to put money into vocational coaching and technical training. This give attention to capability constructing ensures that native populations are geared up to take part meaningfully in infrastructure supply and upkeep.

The advantages additionally prolong to the casual sector, as improved transport networks and power entry empower casual merchants, farmers, and artisans by connecting them to broader markets and decreasing operational prices. With higher infrastructure, these staff can increase their attain, improve productiveness, and transition into extra formalised financial actions.

Learn additionally: Afreximbank, MDGIF sign MoU to mobilise $500m for Nigeria’s gas infrastructure development

From bodily infrastructure to digital transformation

Past bodily infrastructure, the summit will delve into digital transformation. With Africa positioning itself within the world digital and synthetic intelligence (AI) revolution, discussions will discover how fintech, synthetic intelligence, and digital infrastructure can improve service supply, monetary inclusion, and industrial progress beneath the African Continental Free Commerce Space (AfCFTA).

Disussions round water safety and local weather adaptation infrastructure can even function prominently, with emphasis on sustainable financing for transboundary water useful resource administration.

In a bid to scale back reliance on exterior funding, the summit will highlight home capital mobilisation. Africa’s pension and sovereign wealth funds, which is estimated at over $70 billion yearly, can be focused by means of revolutionary public-private fashions, blended finance, and mission bonds.

Registration for the summit, together with alternatives to showcase initiatives and have interaction with organisers, might be made here