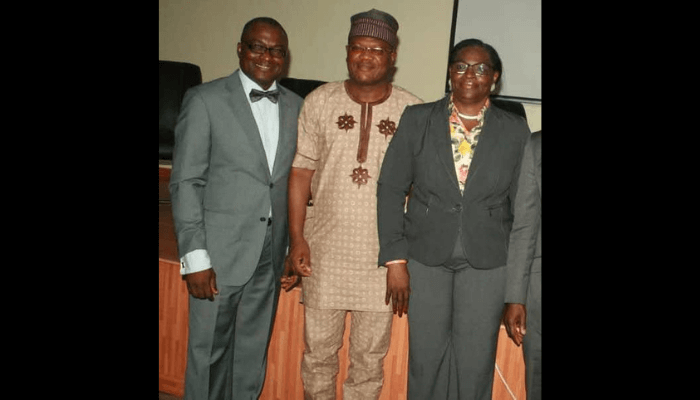

L-R: Olayinka Odutola, DG/CEO, Affiliation of Enterprise Threat Administration Professionals (AERMP); Pius Olanrewaju, President, Chattered Institute of Bankers of Nigeria, and Taiwo Ige, President, AERMP

Enterprise threat administration professionals in Nigeria have taken steps to advertise financial stability within the nation. One in every of such steps is the inauguration of Basel Accord Day and the International Monetary Laws Week.

The professionals, underneath the aegis of Affiliation of Enterprise Threat Administration Professionals (AERMP), did the inauguration throughout a digital ceremony in Lagos not too long ago.

Basel Accords are a collection of banking supervision accords developed by the Basel Committee on Banking Supervision (BCBS) to control the banking sector and promote world monetary stability.

The accords set up minimal capital necessities and threat administration requirements for banks, aiming to enhance their means to resist monetary shocks and improve transparency and threat administration practices.

Throughout the convention, bankers, policymakers, monetary regulators, academia, threat officers, analysts, enterprise threat professionals, fintechs, and different attendees advocated the adoption of the Basel Accord by each banking and monetary establishment for monetary stability.

The specialists praised AERMP for the inauguration of Basel Accord Day, which was a part of actions to mark the newly inaugurated International Monetary Laws Week (FINREG) by the affiliation.

The convention aimed to sensitise bankers and different monetary companies sector stakeholders on the Basel Accord and the way it shapes the financial system and efficiency of economic establishments and the nation.

AERMP President, Taiwo Ige, mentioned the theme, ‘Think about a Monetary World With out the Basel Accord,’ was apt to encourage specialists to discover, interrogate, and reimagine the foundations of worldwide monetary laws.

Ige gave a short historical past of the Basel Accords, starting with Basel I in 1988, by Basel II and the way more refined Basel III and IV, including that the 2 supplied upgraded pointers as lifelines for world monetary stability.

“They’ve helped establishments stay solvent, instilled self-discipline in capital allocation, promoted transparency, and, in lots of circumstances, shielded complete economies from collapse,” she mentioned.

Ige, a fellow of Enterprise Threat Professionals, urged members to proffer options to strengthening threat tradition in Nigeria and Africa in a consistently shifting threat panorama.

She famous that the AERMP would proceed to take daring steps in advancing the frontiers of enterprise threat administration within the nation.

Olayinka Odutola, Director Normal/Chief Govt Officer, AERMP, mentioned the affiliation was the primary globally to inaugurate and have fun a Basel Accord Day in addition to the International Monetary Laws Week.

He mentioned the inaugurations have been necessary as a result of regulators within the monetary sector have been unsung heroes who ought to be celebrated for his or her outstanding roles.

Odutola, additionally a fellow of the affiliation, mentioned individuals must know extra about regulators; although not good, their absence might destroy banking establishments and the economies of nations.

He defined that the convention was about studying to know the ideas of the Basel Accord, declaring the implications of not having or practising it.

Blaise Ijebor, the Director, Threat Administration, Central Financial institution of Nigeria, delivering a keynote, mentioned the Basel Accord was instituted to revive confidence after shocks that collapsed some outstanding banks in Europe.

Blaise, a chartered threat administration skilled and fellow of the affiliation, mentioned the Basel Accord had launched effectivity into transborder transactions and different nationwide banking practices.

He added that threat specialists are guardians of belief for organisations whereas reeling out moral necessities for the professionals to spice up traders’ confidence and investments in Nigeria.

He defined efforts of the CBN on adoption of the Basel Accords in addition to ongoing efforts to improve to the best and newest model.

Temidayo Fasipe from the Growth Finance Establishments Supervision Division of CBN, spoke on the subject: ‘Basel Accords: Journeys from Basel I to IV.’

He mentioned that an analytical exploration of the evolution and key reforms of the Basel Accords aimed toward strengthening world banking stability by successive monetary disaster impacts and regulatory milestones.

Fasipe defined the function of the Basel Accord in banking regulation to forestall each banking and foreign money crises in addition to stability of cost crises.

In line with him, banking crises should not frequent, however the affect of their incidence is often excessive, therefore, the necessity for efficient regulation.

“Traditionally, the absence of a central financial institution has led to extreme monetary crises, demonstrating the necessity for regulatory oversight,” he mentioned.

Bayo Olugbemi, a former President, Chartered Institute of Bankers of Nigeria, and Biodun Adedipe, a fellow of the affiliation, spoke on how actions or inactions of execs might affect the entire world both positively or negatively.

They agreed that if professionals did it proper by not reducing corners, and pay desired consideration to the regulatory frameworks just like the Basel Accord, Nigeria and world economies would expertise stability.

Dignitaries on the occasion included Kehinde Adetiloye and Ochei Ikpefan, each professors and of Finance Division of Covenant College; Prof Ehi Esoimeme and Dr Sam Utulu of James Hope College; Francis Agboola, former Director/Chief Studying Officer, NDIC, amongst others.