…Points focused transitional pointers for choose banks

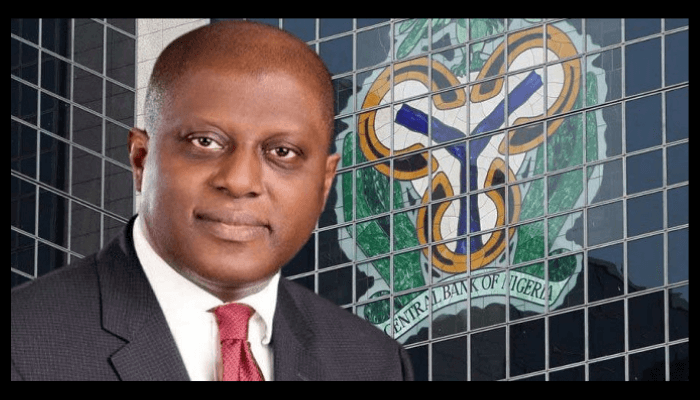

The Central Financial institution of Nigeria (CBN) has reaffirmed the resilience and soundness of the Nigerian banking sector whereas unveiling a set of focused transitional measures affecting a choose variety of monetary establishments.

These measures symbolize the ultimate part in winding down the short-term regulatory lodging launched within the aftermath of the COVID-19 pandemic, and are meant to consolidate the positive aspects achieved throughout that interval of remarkable assist.

The measures, introduced in a round signed by Hakama Sidi Ali, appearing director of Company Communications, usually are not broad-based however as a substitute apply to a restricted group of banks. They embody short-term restrictions on actions such because the fee of dividends and the disbursement of bonuses to govt administration.

In keeping with the CBN, these restrictions are supposed to preserve inner capital, strengthen capital adequacy, and bolster long-term institutional resilience. The banks affected have been formally notified and are at the moment below enhanced regulatory engagement and shut supervisory monitoring.

The regulatory transfer kinds a part of the CBN’s sequenced and structured implementation of the banking sector recapitalisation programme, which was formally launched in 2023. The programme is designed to align the banking sector with Nigeria’s broader financial growth targets and guarantee banks stay well-capitalised in keeping with the evolving calls for of a rising economic system. Nearly all of Nigerian banks have both met or are firmly on observe to fulfill the brand new capital thresholds forward of the March 31, 2026 deadline set by the apex financial institution.

To assist this transition, the CBN stated it’s offering narrowly outlined allowances inside its capital framework, guaranteeing flexibility with out compromising prudential requirements. These provisions are totally aligned with world greatest practices and replicate the CBN’s dedication to sustaining a forward-looking, risk-based regulatory atmosphere. In actual fact, Nigeria’s Danger-Based mostly Capital necessities already exceed the minimal benchmarks set by the Basel III framework, highlighting the regulator’s proactive posture in safeguarding the monetary system.

The central financial institution pressured that these actions are fully routine inside the broader framework of supervisory oversight and replicate worldwide requirements.

Emphasising its ongoing dedication to transparency and collaboration, the CBN reaffirmed that it’s going to proceed to have interaction stakeholders throughout the monetary business by established platforms together with the Bankers’ Committee, the Physique of Financial institution CEOs, and different related business teams. The engagement is predicted to make sure that regulatory adjustments are well-understood, predictable, and successfully applied with business enter.

The CBN restates that Nigeria’s banking system stays basically sturdy, secure, and well-capitalised. The transitional pointers introduced don’t sign misery inside the system however are as a substitute a part of a broader, methodical reform course of aimed toward future-proofing the sector. The apex financial institution underscored that these steps are designed to make sure that the banking business stays a stable basis for inclusive, sustained financial progress and nationwide growth.