Nigeria has formally opened purposes for the Cabotage Vessel Financing Fund (CVFF), a scheme created 23 years in the past, to unlock structured financing for indigenous shipowners however by no means absolutely operationalised.

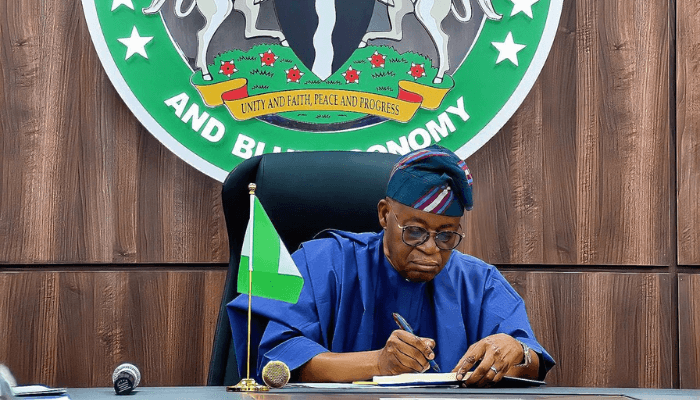

Adegboyega Oyetola, the minister of Marine and Blue Financial system, on Thursday launched the CVFF utility portal in Lagos, activating the primary concrete mechanism by means of which Nigerian delivery firms can apply for funding underneath the Cabotage Act.

The portal, which will probably be managed by the Nigerian Maritime Administration and Security Company (NIMASA), permits eligible Nigerian shipowners to submit purposes digitally.

Purposes will probably be evaluated by means of permitted Major Lending Establishments, which is able to deal with due diligence, credit score evaluation and mortgage administration.

The CVFF was established underneath the Coastal and Inland Transport Act of 2003 to supply long-term financing for Nigerian-owned vessels working in home waters.

Regardless of regular contributions to the fund over time, now value over $700 million, it remained inaccessible, leaving native operators reliant on overseas financing or foreign-flagged vessels.

Learn additionally: ‘We propose using the Cabotage fund to build a sustainable ship-management ecosystem’

Officers say the portal is designed to handle longstanding issues about transparency and governance that stalled earlier disbursement efforts. The method will probably be absolutely digital, with outlined eligibility standards and monitoring mechanisms constructed into the system.

Based on Oyetola, the fund is structured as a revolving facility, that means beneficiaries are anticipated to repay loans to maintain future lending. The purpose is to scale back overseas dominance within the nation’s delivery business.

“We hope to scale back reliance on foreign-flagged vessels in our coastal commerce, enhance retention of worth inside the home financial system, create employment alternatives for Nigerian seafarers and stimulate progress in allied sectors such a shipbuilding, ship restore and maritime companies,” he stated.

Dayo Mobereola, director-general of NIMASA, stated the company has created a devoted CVFF unit to handle purposes, liaise with lenders and oversee compliance. He stated the main target can be on threat administration, skilled oversight and strict adherence to eligibility guidelines.

Lawmakers from the Senate and Home committees on marine transport and maritime security stated they’d again the implementation by means of legislative oversight, whereas business representatives stated entry to predictable, long-term financing stays vital for vessel acquisition, fleet renewal and competitiveness, notably as Nigerian operators face increased borrowing prices than their overseas counterparts.

In 2025, Oyetola instructed NIMASA to start preparations for CVFF disbursement, assuring the business of disbursement in August. Nevertheless, execution stalled as shipowners remained locked out until the top of the 12 months.

Beneath the framework, eligible companies could entry financing of as much as $25 million every to accumulate vessels that meet worldwide security and efficiency requirements, with lending dealt with by means of vetted monetary establishments.

Bashir Jamoh, the previous DG, had in 2024 said that NIMASA couldn’t begin disbursing the cash within the Cabotage Fund with out first partaking with banks and shipowners.

NIMASA appointed 12 Major Lending Establishments (PLIs) to manage the funds, seven greater than the 5 that former President Buhari permitted in 2023, together with Polaris, Zenith, Union and Jaiz banks, plus the UBA.

Mobereola stated the banks will lend 35 % whereas NIMASA will lend the opposite 50 %, whereas the beneficiary of the fund will present the remaining 15 % fairness shares.