38

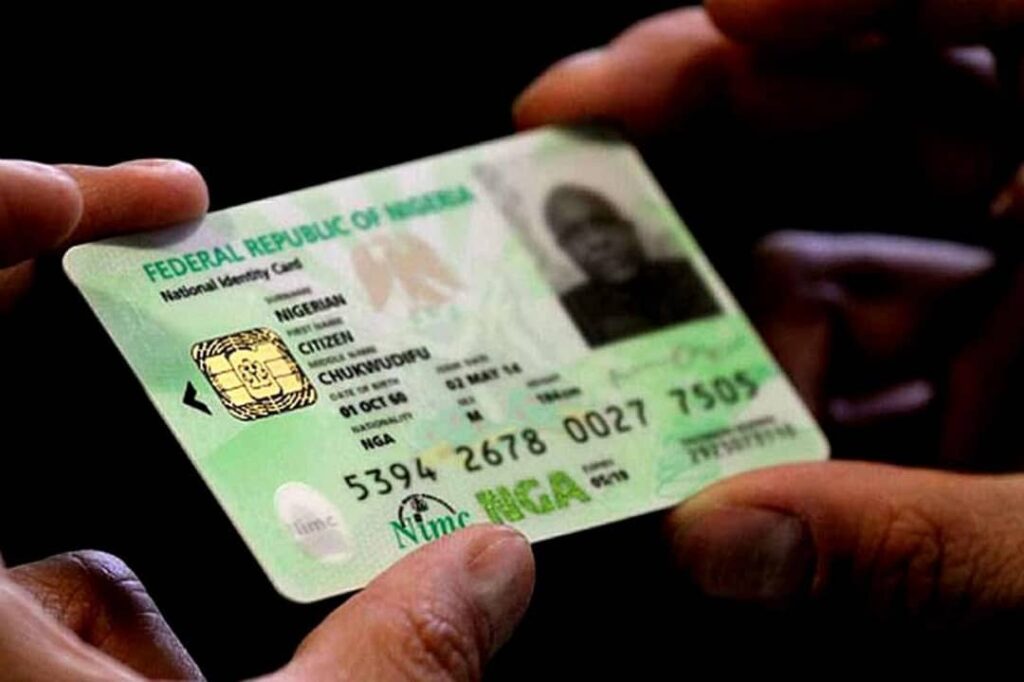

The Federal Authorities is ready to roll out a landmark reform linking Nigerians’ credit score scores to their Nationwide Identification Numbers (NIN), in a transfer designed to determine a unified and clear credit score system throughout the nation.

Asserting the event at a State Home media briefing in Abuja, Tuesday, Managing Director of the Nigerian Shopper Credit score Company (CREDICORP), Uzoma Nwagba, stated the initiative goals to consolidate credit score information from all monetary establishments, banks, fintechs, and microfinance suppliers right into a central nationwide credit score bureau.

“This marks a elementary shift in how credit score works in Nigeria. Your NIN turns into your monetary anchor. Whether or not you’ve borrowed from a financial institution, micro-lender, or fintech, your file shall be tracked and can carry penalties,” Nwagba said.

In line with him, the transfer will construct a nationwide credit score database, providing every citizen a credit score profile formed by their borrowing and compensation behaviour.

He warned that mortgage defaulters will quickly face tangible penalties, together with issue renewing passports, driver’s licenses, or securing housing. “There shall be no hiding place,” he stated.

All monetary establishments, he added, will now be mandated to report credit score exercise. The system, nonetheless, is designed to encourage accountable borrowing with out being punitive.

“This isn’t about punishment. It’s about selling self-discipline and rewarding monetary accountability,” Nwagba defined.

He revealed that the system may also incorporate monetary and non-financial information to generate a complete credit score scoring algorithm for each Nigerian grownup.

“The purpose is straightforward: each Nigerian should have a credit score rating. Entry to financial alternatives shall be tied to the way you handle your funds.”

The broader goal, Nwagba famous, is aligned with President Bola Tinubu’s Renewed Hope Agenda, focusing on improved dwelling requirements, decreased corruption, and industrial development.

“This isn’t nearly credit score. It’s about giving individuals entry to higher lives. When individuals lack capital to satisfy their wants, they might resort to unethical practices. We’re altering that,” he stated.

He added that the reform would additionally increase native manufacturing by tying credit score services to the acquisition of made-in-Nigeria items, stimulating demand, creating jobs, and supporting sustainable financial development.

Nwagba referred to as on the personal sector to actively assist the initiative, stressing that Nigeria’s credit score hole, estimated at ₦183 trillion, can’t be bridged by the federal government alone.

“No authorities can fund that degree of credit score. However with sturdy establishments and transparency, lenders may have extra confidence, rates of interest will fall, and Nigerians may have actual entry to inexpensive credit score,” he stated.

CREDICORP can be driving “YouthCred,” a brand new programme aimed toward extending structured credit score to younger Nigerians, particularly members of the Nationwide Youth Service Corps (NYSC).

“YouthCred is now not an thought. It’s in movement. The programs are prepared, and rollout is underway,” Nwagba confirmed.

Government Director of Operations at CREDICORP, Olanike Kolawole, added that the programme is designed to instil monetary confidence and inclusion amongst youths aged 18 to 35.

“YouthCred isn’t just about loans, it’s about constructing a financially literate technology. As we broaden, we’re guaranteeing younger individuals have the instruments and habits to succeed,” she stated.

The credit-NIN integration, each officers stated, can be anticipated to rework how residents work together with public companies and civic processes in Nigeria.

Publish Views: 144