…As missiles fly within the Center East, the financial shockwaves are already hitting dwelling.

…The Center East is the world’s foremost oil-producing area and a significant maritime route

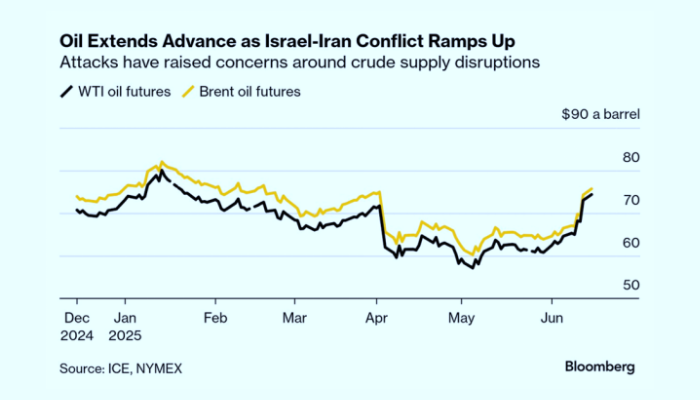

The worldwide oil market has as soon as once more been thrust into turmoil, this time by the escalating battle between Israel and Iran. As tensions flare within the Center East—a area central to international vitality provide—oil costs have develop into more and more risky, swinging in response to fears of disruption. On Tuesday, June 17, 5 days after the brand new hostilities, oil costs had been pushed even greater with Brent and WTI up greater than 2 %.

Fairness markets had been additionally initially roiled after the shock strike however have since stabilised.

Because the lethal salvo entered the fifth day, there have been rising considerations that the battle would unfold throughout different world’s key oil-and-gas-producing areas, together with oil-dependent nations like Nigeria. The most recent outbreak is a essential addition to the floundering international economic system that’s teetering on the cusp of a worldwide recession.

Nigeria depends on crude oil for almost all of its overseas change earnings and a considerable portion of presidency income. Whereas a spike in oil costs might sound useful on the floor, it typically comes with a double-edged sword, portending a mixture of dangers and upsides for the economic system. Larger costs can increase income, however additionally they inflate the price of petrol subsidies—already a significant fiscal burden—and disrupt price range assumptions primarily based on steady benchmarks.

Surging oil costs supply a short lived fiscal cushion, however for Nigeria, the actual battle is at dwelling—towards inflation, forex devaluation, and shaky investor confidence. Can the nation stand up to one other international storm with out slipping deeper into disaster?

Learn additionally: Oil rally strengthens CBN’s bid for stable naira, FX reserves

Context

A decade-old battle between Israel and Iran that was by no means fairly gone “chilly” quickly heated up once more on the morning of Friday, June 13, when Israel launched fusillades of air strikes on Iran in what its chief claimed had been “pre-emptive” measures to forestall Iran from constructing nuclear armament, however many international locations take into account the strike as unprovoked and unpremeditated, as talks had been nonetheless ongoing between Iran and the US over Iran’s JCPOA nuclear programme deal, which Iran says is for peaceable means. Within the days after the primary assault towards the Iranian nuclear programme and army management, greater than 2 hundred folks have been killed in Iran and a minimum of two dozen in Israel, with over 17 million residents of Tehran in flight mode.

After all, most of the preliminary impacts had been predictable: oil costs soared, inventory costs plunged, and bonds rallied as buyers sought security amidst the market turbulence and uncertainty. Nevertheless, the longer-term results are much less simply anticipated, provided that they rely on the extent to which the battle escalates.

Economies around the globe are at present grappling with elevated geopolitical pressure triggered by the Russian-Ukrainian struggle and the Israel-Hamas battle. There may be additionally the profound uncertainty created by the unprecedented tariff disruptions by the Trump administration, along with the escalating hostilities. Brent crude has been pushed towards $73–74/barrel, up roughly 0.5 %, with intraday jumps over 2 %. The most recent spike adopted the same development of oil worth shocks triggered by key geopolitical flashpoints, together with management assassinations and army escalations. Every occasion, from Iran’s missile response in April 2024 to the toppling of Syria’s President in December 2024, has added volatility, fuelling investor anxiousness.

Oil worth volatility has now rippled into forex and inflation pressures throughout oil-importing economies—together with Nigeria.

Rising oil costs bolster the U.S. greenback, rising demand for safe-haven currencies. For Nigeria, this interprets into naira weak point: the official charge hovers close to ₦1,543/USD, whereas the parallel market stays round ₦1,550–₦1,600/USD. A weaker naira inflates the price of imports, feeding home inflation, already close to 23 %.

To curb the outflow of overseas change and stabilise the forex, the Central Financial institution of Nigeria has leaned closely on intervention and tight financial coverage. Charges stay close to 27.5 %, following a number of hikes totalling over 875 foundation factors since 2024.

The mixed impact: an elevated value of dwelling, elevated borrowing prices, and tighter budgetary house. As geopolitical uncertainty persists, Nigeria’s forex and inflation outlook stay in danger, requiring vigilant coverage response to forestall imported inflation from undermining financial resilience.

Learn additionally: Nigeria’s oil output falls despite rising global prices

Far-reaching implications for Nigeria

The unfolding Israel–Iran battle has rattled investor sentiment, with implications for Nigeria’s capital flows. In line with SBM Intelligence, escalating hostilities have triggered “risk-averse sentiment in international markets”, endangering Nigeria’s capacity to draw overseas direct funding (FDI) and portfolio inflows. The ripple results embody stalled infrastructure initiatives, slower job creation, and elevated sovereign borrowing prices as a result of heightened nation danger premiums.

In line with oilprice.com, Nigeria’s crude oil costs have climbed within the 5 days of the struggle—Bonny Mild nearing $80/barrel (traded at $78.62 on Tuesday), with Brass River and Qua Iboe fetching ~$76, surpassing the federal government’s $75 price range benchmark. Whereas this quickly boosts FX inflows and reserves, reliance on locked-in contracts means windfalls are inconsistent. Extra critically, geopolitical uncertainty raises borrowing prices and undermines FDI inflows even amid greater revenues.

The Centre for the Promotion of Personal Enterprise (CPPE) warns that elevated vitality costs and international tensions could set off imported inflation and “shaken investor confidence”, doubtlessly curbing portfolio flows. Corporations with Center East ties face provide chain disruptions, whereas financiers reassess danger publicity.

In sum, regardless of transient oil-price good points, long-term investor confidence in Nigeria is beneath pressure. Policymakers should urgently reinforce fiscal stability, reassure overseas buyers, and mitigate capital movement volatility to safeguard financial resilience.

Wanting forward: Coverage response and financial resilience

On this second of world uncertainty, Nigeria faces a fragile balancing act. The federal government should navigate rising oil revenue with out dropping grip on inflation, public spending, or change charge pressures.

Whereas the current oil worth rally supplies Nigeria with some fiscal respiration house, the nation’s long-term financial resilience hinges on how successfully it manages the inflationary fallout and rising geopolitical dangers. Specialists emphasise that bettering home refining capability, rising oil manufacturing, and deploying proactive financial measures are key to mitigating exterior shocks.

The anticipated nationwide distribution of petrol by the Dangote Refinery in August 2025 presents a possible buffer towards imported inflation and foreign exchange pressure from gasoline imports. Nevertheless, till then, Nigeria stays extremely weak to the ripple results of the Israel-Iran battle and international vitality market instability.

In the end, Nigeria stands at a pivotal crossroads: strategic coverage coordination, fiscal self-discipline, and well timed financial reforms are important not simply to navigate the present disaster however to transform international volatility into a possibility for sustainable development. This second calls for daring management and a clear-eyed dedication to long-term macroeconomic stability.