Africa’s monetary panorama is opening 2026 with a mixture of quiet resilience and structural transition. Overseas capital is selectively returning at the same time as world banks retreat, inflation pressures are easing throughout key economies, and regulatory reforms are reshaping investor notion from Nairobi to Lagos.

Under are the defining finance tales shaping the continent this week — and why they matter.

Swiss banking large Pictet makes Africa debut amid international banks’ exit

Banque Pictet & Cie has opened its first African office after receiving approval to determine a consultant presence in South Africa, marking the Swiss non-public financial institution’s entry into the continent for the primary time in its greater than 220-year historical past.

The transfer comes at the same time as a number of world lenders — together with HSBC and BNP Paribas — have exited or scaled again African operations over the previous decade attributable to compliance prices, foreign money volatility, and saturated markets. Others, akin to Barclays, Customary Chartered, and Financial institution of Baroda, have lowered their footprints.

Why it issues: Pictet’s entry indicators a shift from broad business banking towards focused wealth and asset-management performs in Africa. Slightly than abandoning the continent, world capital is turning into extra selective — specializing in high-net-worth shoppers, secure regulatory hubs, and cross-border funding flows.

South Africa’s unemployment falls to five-year low regardless of US tariff shock

South Africa’s unemployment rate declined to 31.4 p.c in This fall 2025, the bottom stage in additional than 5 years, easing from 31.9 p.c within the earlier quarter. Job good points in neighborhood providers and building helped offset fears that the 30 p.c US tariffs would set off widespread layoffs in Africa’s most industrialised economic system.

Why it issues: The development suggests home labour momentum is proving extra resilient than exterior commerce shocks. For buyers, stabilising employment helps consumption, credit score progress, and monetary restoration — at the same time as geopolitical commerce dangers linger.

Africa’s greatest markets usher in 2026 with charge cuts as inflation cools

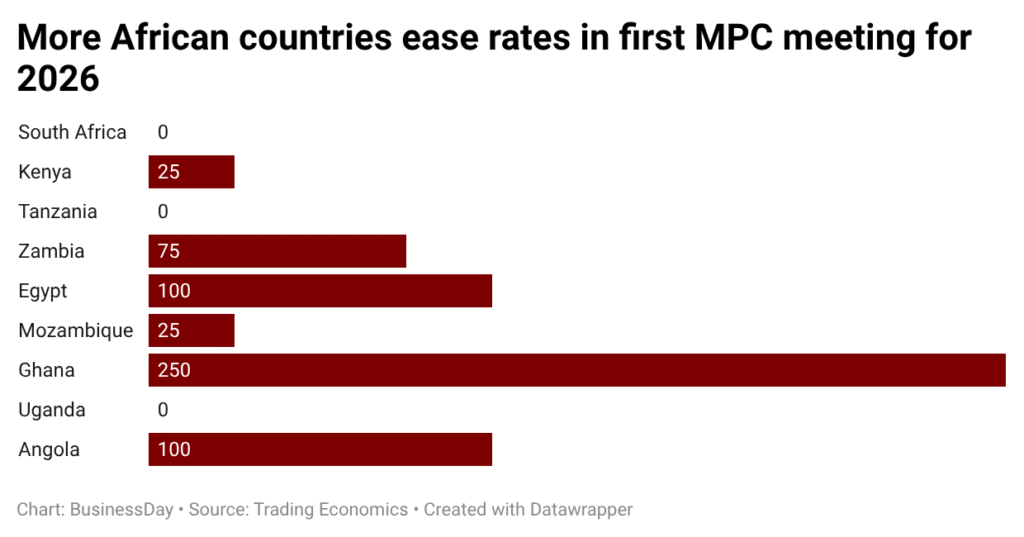

A rising wave of African central banks has begun slicing rates of interest to multi-year lows as inflation slows, currencies stabilise, and commodity costs — notably treasured metals — strengthen exterior balances.

Out of 9 international locations holding early-2026 coverage conferences, six minimize charges: Kenya, Egypt, Angola, Ghana, Mozambique, and Zambia. Uganda, South Africa, and Tanzania opted to carry.

Why it issues: This marks the continent’s first broad easing cycle because the world inflation shock of 2022–2023. Decrease borrowing prices may revive credit score, funding, and progress — but in addition take a look at foreign money stability if cuts transfer quicker than world financial easing.

Kenya eyes exit from money-laundering gray checklist as regional banks deepen footprint

Kenya is focusing on a Might 2026 exit from the worldwide financial-crime watchdog’s gray checklist after strengthening anti-money-laundering and counter-terrorism financing controls.

Treasury officers say reforms include new legislation, tighter supervision of digital asset suppliers, stricter due diligence guidelines, and improved inter-agency enforcement — steps geared toward restoring world monetary confidence.

Why it issues: Gray-list removing may unlock correspondent banking entry, cut back transaction prices, and entice international capital. The timing is vital as regional and pan-African banks increase into Kenya, betting on its standing as East Africa’s monetary hub.

Nigeria joins African friends as meals inflation slows to single digit

Nigeria’s meals inflation dropped to eight.89 p.c in January 2026, the primary single-digit studying since Might 2015 and the sixth straight month-to-month decline. The slowdown aligns Africa’s most populous nation with friends akin to Ghana, Ethiopia, and Zimbabwe which have just lately recorded easing meals costs.

Why it issues: Meals costs drive greater than half of Nigeria’s inflation basket, which means sustained moderation may reshape financial coverage, family spending, and political stability. If maintained, it might open the door to Nigeria’s personal interest-rate easing cycle later in 2026.

Chart for the Week