The Central Financial institution of Nigeria (CBN) and the Financial institution of Angola have signed a Memorandum of Understanding (MoU) to strengthen monetary sector regulation and deepen financial cooperation between each nations, consistent with Africa’s broader objectives of integration and monetary stability.

“Cardoso mentioned the CBN had been “lucky” to have applied reforms early, permitting the financial system to construct resilience and buffers in opposition to potential shocks.”

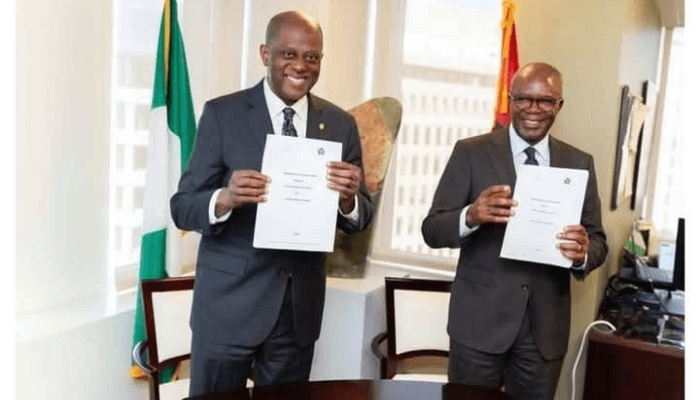

The settlement, signed on the sidelines of the 2025 Worldwide Financial Fund (IMF) and World Financial institution Annual Conferences in Washington, D.C., will allow the 2 apex banks to trade technical help, improve cost methods, and assist monetary sector improvement.

CBN Governor Olayemi Cardoso signed on behalf of Nigeria, whereas Manuel Antonio Tiago Diaz, governor of the Financial institution of Angola, signed for his nation. Each leaders mentioned the MoU “aligns with Africa’s broader objectives of financial integration and monetary stability” and marks a “vital improvement” in efforts to deepen bilateral cooperation and technical trade.

Strengthening Africa’s monetary spine

Below the brand new framework, each establishments are anticipated to ascertain a bilateral discussion board for the reciprocal trade and sharing of technical help to boost capability in executing central banking features.

They’ll cooperate within the cross-border supervision of authorised establishments, trade cybersecurity data, and collaborate on licensing, supervision, decision planning, and implementation of decision measures for cross-border monetary institutions.

The MoU additionally requires clear and easy periodic data trade, with outlined procedures to manipulate it. The cooperation will prolong to trade management, monetary markets, international reserve administration, foreign money administration, and financial analysis.

It’s going to additionally cowl cost, clearing, and settlement methods administration, banking supervision and regulation, monetary sector improvement, and efforts to fight cash laundering and terrorism financing.

In line with each governors, the “consequence of the MoU implementation can be a win-win for each events.”

Laying the muse for monetary integration

The partnership comes at a time when African central banks are looking for to consolidate regional monetary cooperation as a method of driving financial stability and integration.

A financially steady Africa, the assertion mentioned, “comes with nice advantages for the continent.” Past creating a bigger single market, such stability would enhance intra-African commerce, enhance productiveness and competitiveness, and assist entice extra international direct funding.

The MoU, in line with each central banks, will function a platform for institutional collaboration that promotes stability and strengthens the capability of regulators to handle rising dangers within the monetary system.

Nigeria showcases reform progress in Washington.

As a part of efforts to spice up investor confidence and strengthen Nigeria’s financial outlook, the CBN Governor and Doris Uzoka-Anite, the Minister of State for Finance, held a high-level engagement with international traders in the course of the IMF and World Financial institution Annual Conferences.

They have been joined by CBN Deputy Governor (Financial Coverage) Mohammed Abdullahi, Particular Adviser to the President on Finance and the Financial system Sanyade Okoli, and different senior officers.

The session supplied a complete replace on Nigeria’s macroeconomic reforms, fiscal-monetary coordination, and insurance policies shaping the nation’s development trajectory.

Governor Cardoso highlighted “sustained stability within the international trade market, regular accumulation of exterior reserves, and rising investor participation throughout fastened revenue and equities.”

He mentioned, “Nigeria’s focus stays clear: strengthening our fundamentals, advancing reforms, and unlocking alternatives for sustainable funding and development. We’re inspired by the progress made thus far and stay assured that ongoing reforms are laying a stronger basis for a extra resilient financial system.”

The Nigerian delegation reaffirmed the federal government’s dedication to coverage consistency and continued reform momentum, creating an atmosphere that’s open, clear, and enticing to long-term capital.

Members on the assembly expressed optimism that Nigeria’s strengthened establishments, enhanced investor belief, and ongoing reforms will proceed to drive sustainable development and broaden alternatives for all stakeholders.

Constructing a resilient financial system

Cardoso, who additionally led the Nigerian delegation to the conferences, mentioned on the Intergovernmental Group of Twenty-4 (G-24) press briefing that “Nigeria’s financial system has been totally restructured and is now resilient, with large buffers in opposition to international dangers.”

He famous that “the naira has equally emerged as a aggressive foreign money, with the financial system witnessing optimistic commerce balances and huge companies transferring from imports to exports of regionally produced items and commodities.”

In line with him, “the optimistic financial indicators have mixed to create resilient and powerful buffers, maintaining the financial system in nice form.”

On the affect of commerce tariffs, the CBN Governor mentioned, “For us once more, oil is mainly the one commodity that was so uncovered to the tariffs, and the affect of that was comparatively modest. We now have a extra aggressive foreign money, with the outcome that, for as soon as, now we have a scenario the place now we have a optimistic steadiness of commerce surplus, and we count on it to be six % in GDP for a while.”

He added, “So mainly, what is occurring is an entire restructuring of the financial system, the place we’re encouraging individuals to enter home manufacturing and, in fact, discouraging imports.”

Cardoso mentioned the CBN had been “lucky” to have applied reforms early, permitting the financial system to construct resilience and buffers in opposition to potential shocks.

The CBN Governor additionally praised the G-24’s function in “discovering options to international challenges by dialogue and trade of concepts with international monetary establishments,” noting that though international development stays gradual, “it isn’t as behind as would have been anticipated.”

IMF applauds reforms.

The IMF has credited Nigeria’s financial tightening and trade charge reforms for serving to cut back inflation and restore market confidence.

Abebe Selassie, director of the IMF’s Africa Division, mentioned the reforms “performed a big function within the gradual drop of the inflation charge to 18.02 per cent in September.”

He mentioned, “The Fund is inspired by the September inflation charge however suggested that the federal government do extra to deliver down the price of residing for the individuals.”

Nigeria’s inflation charge declined to 18.02 % in September 2025, down from 20.12 % in August, marking a six-month streak of decline and the bottom in over three years.

Selassie added that the reforms “will additional assist the projected 3.9 per cent development for 2025 and 4.1 per cent development for 2026.”

He defined that to rein in inflation, the CBN “tightened coverage aggressively, elevating charges by greater than 800 foundation factors and strengthening liquidity administration.”

He additionally counseled the financial institution’s resolution to “halt central financial institution financing of presidency past statutory limits and re-anchor financial coverage on its core mandate”, describing it as instrumental within the inflation decline.

The IMF mentioned Sub-Saharan Africa stays resilient, projecting development of 4.1 % in 2025 and a modest pickup in 2026, supported by macroeconomic stabilisation and reform efforts in key economies.

Nonetheless, Selassie warned that overlapping financial, fiscal, and exterior vulnerabilities persist. “Uncertainty stays, and dangers are tilted to the draw back,” he mentioned. “Home income mobilisation and strengthened debt administration will help bolster macroeconomic stability whereas funding important improvement wants.”

He added that “common public-debt ratios have stabilised however at an elevated stage”, with debt-service burdens rising and crowding out improvement spending in a number of nations, together with Nigeria and Kenya.

Tax reforms are exhibiting outcomes.

The IMF additionally counseled Nigeria’s tax reforms and the willpower to lift non-oil income. Division Chief, Fiscal Affairs Division, Davide Furceri, mentioned, “Nigeria has finished considerably nicely in bettering income by tax reforms and streamlining the tax code.”

He defined that on the income aspect, there may be scope to enhance mobilisation by tax administration reforms, noting, “Really, Nigeria has finished quite a bit up to now years. Most of the legal guidelines which were handed have tried to streamline the tax code.”

Furceri added, “These are insurance policies that go in the suitable course. On the spending aspect, there may be scope to enhance effectivity and enhance social spending to handle social vulnerability within the nation.”

Towards a extra steady continent

The CBN–Financial institution of Angola MoU marks a tangible step towards monetary cooperation and integration in Africa. By emphasising shared technical capability, regulatory alignment, and clear data trade, each central banks say they count on the partnership to be a “win-win” consequence that enhances their respective monetary methods.

As the 2 nations transfer to implement the settlement, the collaboration is anticipated to assist consolidate Africa’s monetary structure, assist funding, and promote the continent’s long-term imaginative and prescient of a steady and built-in financial system.