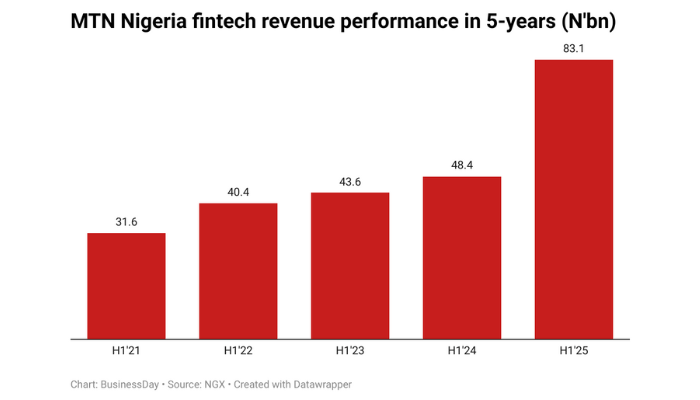

MTN Nigeria’s fintech arm has recorded its highest half-year income in not less than 5 years, because the telecommunications big continues to deepen its play within the digital monetary companies area.

In response to the corporate’s monetary outcomes, fintech income surged by 71.8 p.c to N83 billion within the first half of 2025, up from N48.4 billion in the identical interval of 2024. The determine represents a pointy improve from N31.6 billion reported in H1 2021, highlighting the corporate’s fast fintech growth trajectory.

“Fintech income grew primarily by the robust efficiency of the airtime lending product (Xtratime) and development in superior companies, supported by the onboarding of high-value clients,” the corporate said in its report.

Learn additionally: Top five fintech deals in Africa in H1

The report added that MTN’s strategic concentrate on increasing its fintech choices seems to be paying off, with buyer deposits rising considerably.

“Our continued concentrate on increasing superior companies and enhancing the standard of our fintech ecosystem has attracted extra high-value customers as we leverage our associate ecosystem, contributing to sustained development in buyer deposits, which elevated by roughly fivefold in comparison with December 2024,” the corporate mentioned.

Regardless of the expansion in income and deposits, the variety of energetic MoMo wallets declined by 6.1 p.c to 2.7 million in comparison with December 2024. Nonetheless, the corporate famous a rebound within the second quarter of the yr, with the addition of roughly 562,000 new wallets throughout the interval.

Additionally exhibiting enchancment had been MTN’s distribution metrics: the variety of energetic brokers grew by 49.7 p.c, and retailers onboarded rose by 3.5 p.c, each in comparison with December 2024.

These figures, MTN mentioned, replicate its technique to optimise the standard of its distribution community and construct a extra sustainable fintech base.

Karl Toriola, the corporate’s CEO reaffirmed the corporate’s dedication to accelerating development within the fintech phase.

“We’re dedicated to executing our fintech development technique. After recalibrating our technique earlier this yr, we’re inspired by the constructive tendencies noticed within the second quarter and the renewed momentum within the broader ecosystem,” Toriola mentioned.

Learn additionally: Fintech grabs 45% of Africa’s startup funding in H1 2025

Toriola additionally emphasised the function of superior companies and strategic partnerships in driving MTN’s fintech development.

“We’ve got attracted a better variety of high-value customers, leveraging our associate community, which has helped to spur sustained development in buyer deposits, which rose by practically fivefold by June 2025, in comparison with December 2024.”