The sustained earnings of Nigeria’s palm oil makers have drawn greater than N2.13 trillion funding into the thriving trade within the final seven years, creating 1000’s of jobs and giving hopes to smallholder farmers.

Presco PLC and Okomu Oil Palm Firm, Nigeria’s largest palm oil makers, have posted document earnings for seven straight years regardless of difficult financial situations.

Pushed by sturdy demand, international alternate (FX) shortage, speedy rising inhabitants and beneficial market traits, Nigeria’s palm oil markers are exhibiting that the trade holds large promise for these taken with seizing the chance.

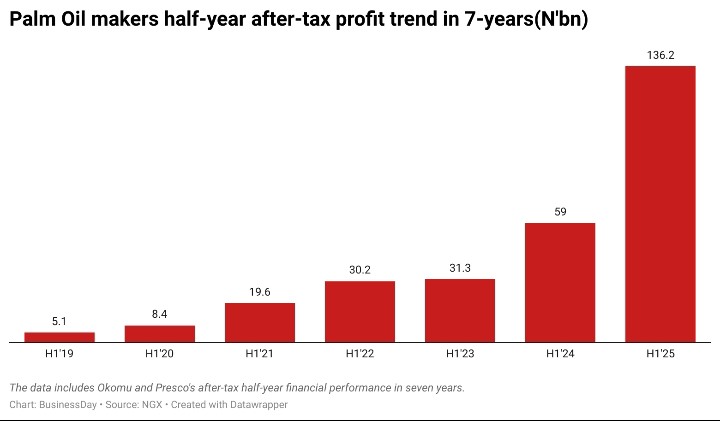

Okomu Oil Palm Firm and Presco Plc collectively recorded a revenue after tax of N136.2 billion within the first half (H1) of 2025 from N5.1 billion 2019, in line with knowledge compiled by BusinessDay.

Learn additionally: Old trees, weak reforms stall Nigeria’s palm oil growth

“Presco and Okomu sustained document features are exhibiting that it makes enterprise sense to put money into palm oil enterprise,” stated Celestine Ikuenobe, former government director of the Nigerian Institute for Oil Palm Analysis (NIFOR).

“Their sturdy outcomes are additionally attracting investments within the palm oil enterprise,” he stated, noting that the companies mirror what is feasible in investing within the manufacturing and processing of the edible oil.

With the tripled earnings recorded by each companies, Ikuenobe famous that there’s much more potential for Nigerian producers to make earnings each from native and worldwide markets because the use for palm oil rises day by day.

“All people consumes palm oil day by day in a single type or the opposite and its industrial use can be growing. This reveals that there are many promise in palm oil manufacturing,” he defined.

Palm oil manufacturing, consumption

Knowledge within the oil palm sector present that the nation produces 1.4 million (MT) each year, with native consumption estimated at 2.7 million MT, in line with knowledge from the Meals and Agricultural Group (FAO).

The determine signifies a demand-supply hole of about 1.3 million MT. The 1.3 million MT provide hole within the nation reveals potential for brand new buyers, consultants say.

About 90 % of palm oil is used within the manufacturing of meals, whereas the remaining 10 % is utilized by the non-foods trade.

Meals like noodles, vegetable oil, biscuits, chips, margarines, shortenings, cereals, baked stuff, washing detergents and even cosmetics are constituted of palm oil. Additionally, firms are actually utilizing it as biodiesel and aviation gas, additional driving demand.

Potential

In accordance with consultants, Nigeria wants a complete plantation of about three million hectares of land if it desires to be self-sufficient within the manufacturing of oil palm to fulfill native demand.

“We’re seeing a pull of recent investments within the trade, and the sustained document earnings by listed palm oil producers is without doubt one of the fundamental components driving this surge,” stated Alphonsus Inyang, president of the Nationwide Palm Produce Affiliation of Nigeria (NPPAN), in a phone response to questions.

Learn additionally: How one policy fuelled Nigeria’s palm oil boom

He famous that regardless of the financial downturn that squeezed most producers within the nation in 2023 and 2024, palm oil makers have been nonetheless in a position to document a stellar efficiency, with the trade driving new investments.

“It’s one subsector that has attracted investments essentially the most within the final three years,” he stated.

Uchenna Uzor, a advertising professor and tutorial director of the Africa Retail Academy at Lagos Enterprise College, stated investor confidence within the palm oil trade is getting greater owing to a mixture of things.

Uzor defined that fixed document earnings, quest for native sourcing, inventive utilization of palm oil past the standard makes use of and export potential in palm kernel are making buyers guess huge on the trade.

“The arrogance of buyers within the palm oil trade could be very excessive and the document earnings by listed operators are fuelling it tremendously,” he stated.

Rising palm oil investments

Nigeria’s palm oil investments are rising quickly. The sector has recorded N2.13 trillion value of funding in seven years, in line with BusinessDay’s compilation of reported investments within the trade.

BUA Group and Alfa Laval PVT Restricted signed a deal in April 2025 to assemble a 1000 metric-ton-per-day (TPD) palm oil refinery and fractionation plant. The price of the funding was not made public.

As of 2024, the United Nations Industrial Growth Organisation (UNIDO) and the Nationwide Palm Produce Affiliation of Nigeria (NPPAN) stated they attracted a €300 million funding to Nigeria’s palm oil trade.

In 2023, Sunora Meals invested $100 million in an oil palm plantation in Edo State to spice up native manufacturing of the commodity.

In 2020, the Central Financial institution of Nigeria (CBN), via its intervention programmes, disbursed a complete of N34.3 billion to main oil palm firms to assist the trade with a plan to plant 100,000ha of palm oil timber by 2025, from 20,000ha in 2020.

As of 2018, PZ Wilmar had invested over $150 million in oil palm plantations in Cross River State alone, BusinessDay was instructed.

Others are investments acknowledged by the Edo Oil Palm Growth Programme and the Delta State Industrial Oil Palm Plantations Growers Cooperative Society Restricted (DELCOM) initiative.