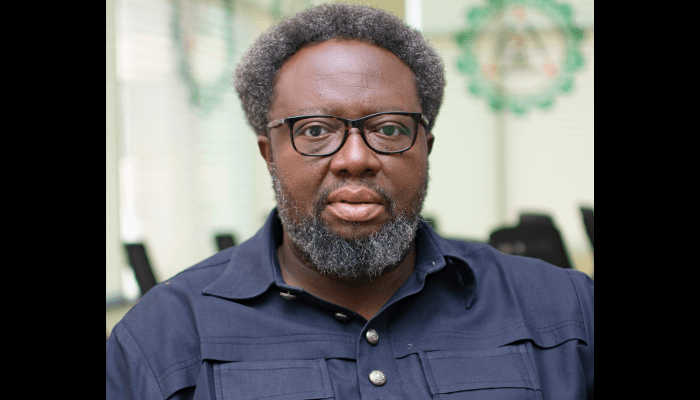

Nnanyelugo Ike-Mounso, Director Common and CEO, Uncooked Supplies Analysis and Growth Council (RMRDC)

The Uncooked Supplies Analysis and Growth Council (RMRDC) has obtained approval to implement pointers for tax incentives focused at fostering Analysis and Growth in addition to the utilisation of native uncooked supplies in Nigerian industries.

Nnanyelugo Ike-Mounso, Director Common and CEO of RMRDC, whereas briefing the media in Abuja on Friday, stated, “The Uncooked Supplies Analysis and Growth Council has now obtained full and formal approval to implement the much-anticipated pointers for tax incentives focused at fostering Analysis and Growth (R&D) and the utilisation of native uncooked supplies in Nigerian industries.”

Learn additionally: Expert advocates grants, tax incentives for interior design industry

He stated the approval is greater than a coverage milestone, however slightly a transformative second, including that it’s “a clarion name to Nigerian researchers, producers, innovators, and entrepreneurs. It’s a sign that the federal government is just not solely listening however appearing to create fertile floor for sustainable industrial innovation and financial diversification.”

The DG recalled that for many years, the RMRDC had spearheaded the mission to harness Nigeria’s considerable uncooked materials assets as a catalyst for industrial improvement.

“We’ve got persistently advocated for insurance policies incentivising industries to put money into native analysis, expertise, and assets. At this time, that imaginative and prescient takes flight.

“The brand new tax incentive framework not solely encourages corporations to put money into R&D actions but in addition rewards them for using Nigerian-sourced uncooked supplies—thus reducing our reliance on imports, strengthening our worth chain, and creating alternatives for native suppliers and producers,” he stated.

Learn additionally: Tax incentives and refunds: Nigeria’s chance to fix its revenue problem

Ike-Mounso, Professor, revealed different key options of the tax incentive to incorporate rewarding industries for investing in native analysis, native expertise, and native assets and lowering price burdens on industries that innovate, construct, and manufacture with domestically sourced options.

He added that the incentives apply to numerous sectors, together with agro-based industries, prescribed drugs, chemical substances, and textiles

He added that the anticipated impression of the tax incentive approval contains lowering reliance on imports, strengthening the worth chain, creating alternatives for native suppliers and producers, fostering job creation and financial progress in addition to supporting President Bola Tinubu’s Renewed Hope Agenda for industrial rejuvenation and self-reliant progress