…trails solely Uganda in continental 2025 PMI rankings

Nigeria sustained enlargement in enterprise exercise all through 2025, signalling the potential for its strongest Gross Home Product development since 2022, as easing inflation and diminished overseas alternate volatility helped stabilise working circumstances, a BusinessDay evaluation of S&P World’s Buying Managers’ Index (PMI) reveals.

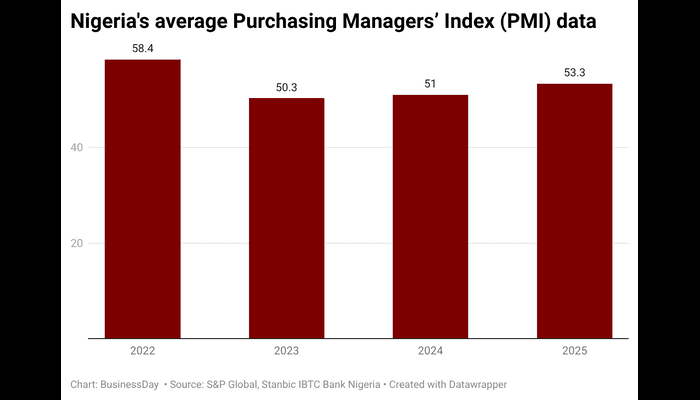

The headline PMI released by Stanbic IBTC Bank Nigeria remained above the 50-point threshold—indicating enlargement—from January to December. On an annual common foundation, Nigeria recorded a PMI of 53.3, up from 51.0 in 2024. This compares with common PMI readings of fifty.3 in 2023 and 58.4 in 2022.

In contrast, Africa’s most populous nation skilled 5 months of contraction in 2024 and 4 in 2023, intervals marked by surging inflation, FX instability, and money shortages that disrupted private-sector exercise.

Knowledge from the Nationwide Bureau of Statistics present that Nigeria’s $252.2 billion economic system grew by 3.98 % within the third quarter of final yr, moderating from 4.23 % within the earlier quarter however stronger than the two.55 % recorded in the identical interval of 2024.

The rebased full-year development stood at 3.40 % in 2024, the very best outturn in three years.

“We anticipate the Nigerian economic system to develop by 3.8 % in 2025 and 4.1 % in 2026,” stated Muyiwa Oni, head of fairness analysis for West Africa at Stanbic IBTC Financial institution. “Manufacturing and companies are prone to file stronger development in 2025 in contrast with 2024, primarily based on PMI tendencies.”

Oni added that authorities funding in infrastructure, livestock improvement, commerce facilitation and oil and fuel, alongside ahead linkages from the Dangote refinery, ought to assist broader development. Decrease rates of interest, according to easing inflation and exchange-rate stabilisation, are additionally anticipated to spice up non-public consumption and enterprise funding in 2026.

The PMI surveys observe enterprise circumstances throughout roughly 400 private-sector companies by measuring new orders, output, employment, suppliers’ supply occasions, and inventories. The index is extensively thought to be a number one indicator of financial momentum.

Additional evaluation reveals that Nigeria was the one main economic system amongst eight African friends to file a full yr of uninterrupted enlargement final yr.

“The Nigerian non-public sector remained in development territory on the finish of 2025 as enhancements in buyer demand fed by way of to greater new orders, output and buying exercise,” S&P World stated in its December PMI report.

The same pattern was mirrored within the Nigerian Financial Summit Group’s (NESG) Enterprise Confidence Monitor, which confirmed that enterprise circumstances remained expansionary in December, extending the streak to 12 consecutive months.

“The NESG–Stanbic IBTC Enterprise Confidence Index remained optimistic for a lot of the yr, reflecting improved investor notion and a gradual restoration in company profitability,” stated Muda Yusuf, founder and chief government of the Centre for the Promotion of Non-public Enterprise. “Many companies that posted losses in 2024 returned to revenue in 2025, underscoring latest stabilisation positive aspects.”

Africa comparability

Amongst main African economies, Egypt recorded the very best variety of contractions at eight months, adopted by South Africa with six and Mozambique with 5. Kenya skilled 4 months of contraction, whereas Ghana had two. Zambia and Uganda recorded the fewest contractions, at one month every.

On an annual common foundation, Nigeria ranked second on the continent with a PMI of 53.3 final yr. Uganda led with a mean PMI of 53.7, whereas South Africa—Africa’s greatest economic system—slipped into contraction at 49.3, down from an expansionary 50.0 a yr earlier.

Egypt, regardless of recording probably the most contractions, improved marginally yr on yr to 49.6 from 48.7, however remained in contraction territory. Ghana, Africa’s best-performing foreign money market, edged as much as 50.8 from 50.4.

The Central Financial institution of Nigeria’s December PMI confirmed a pointy enchancment, with the composite index rising to 57.6 factors—its strongest studying in about 5 years.

The CBN famous that stronger efficiency mirrored a rebound in home demand and bettering productive exercise, notably in non-oil sectors, as companies responded to higher order inflows and easing operational constraints.

The apex financial institution attributed the development to a rebound in home demand and stronger exercise in non-oil sectors as companies responded to greater order inflows and easing operational constraints. It stated ongoing macroeconomic stabilisation measures have helped restore enterprise confidence.

CBN information present the official alternate fee weakened sharply to N1,450/$ in 2024 from N645.10/$ in 2023. Within the first eight months of 2025, the naira traded largely between N1,500 and N1,600 per greenback earlier than strengthening to N1,480.30/$ on September 26, its firmest degree in eight months. Since then, it has remained under N1,500/$.

The naira additionally closed 2025 outdoors Africa’s 10 worst-performing currencies, ending practically two years on the record following sharp devaluations that fuelled volatility and FX shortages.

The improved foreign money stability coincided with a pointy deceleration in inflation. Headline inflation eased from 24.48 % in January to 14.45 % by November, in response to the NBS.

Common inflation fell to twenty.96 % in 2025 from 33.2 % in 2024 and 24.66 % in 2023, reflecting moderating foreign money pressures, decrease petrol prices, and extra steady provide chains.

South Africa posts weakest enterprise exercise in Africa

South Africa recorded the weakest common enterprise exercise on the continent in 2025, with a PMI of 49.3, down from 50.0 in 2024. It additionally posted the second-highest variety of contractions at six months.

The nation closed the yr with a December PMI of 47.7, down from 49.0 in November, signalling a sharper deterioration in working circumstances.

“Enterprise exercise decreased sharply in December, with the contraction widespread throughout sectors and probably the most pronounced since January,” S&P World stated, citing weak demand and tough financial circumstances.

New orders fell for the third consecutive month, with respondents pointing to weaker family spending, diminished enterprise demand and softer export orders.

“After a robust first half, the South African economic system skilled softer circumstances within the fourth quarter,” stated David Owen, senior economist at S&P World Market Intelligence. “The downturn intensified in December as clients reacted to greater costs and broader financial headwinds.”

Inflation in Africa’s greatest economic system eased to three.5 % in November from 3.6 % in October, prompting the South African Reserve Financial institution to chop its benchmark repo fee by 25 foundation factors to six.75 %, the bottom since September 2022.

Uganda sustains high PMI rating

Uganda emerged as Africa’s strongest PMI performer in 2025, sustaining its high rating with a mean index of 53.7, up from 53.3 in 2024. The nation recorded the very best PMI studying in six months of the yr, adopted by Nigeria with 5.

The Uganda Stanbic PMI remained firmly in enlargement territory, supported by sturdy shopper demand and steady macroeconomic circumstances. Annual inflation stood at 3.1 % in December, unchanged from November and the bottom since November 2024.

“Uganda’s non-public sector efficiency displays a resilient home economic system,” stated Christopher Legilisho, economist at Stanbic Financial institution. “Employment circumstances remained steady after ten months of development, whereas rising orders led to mounting backlogs.”

He added that companies expanded buying exercise and inventories to satisfy demand, signalling continued momentum prone to be mirrored in official development information.